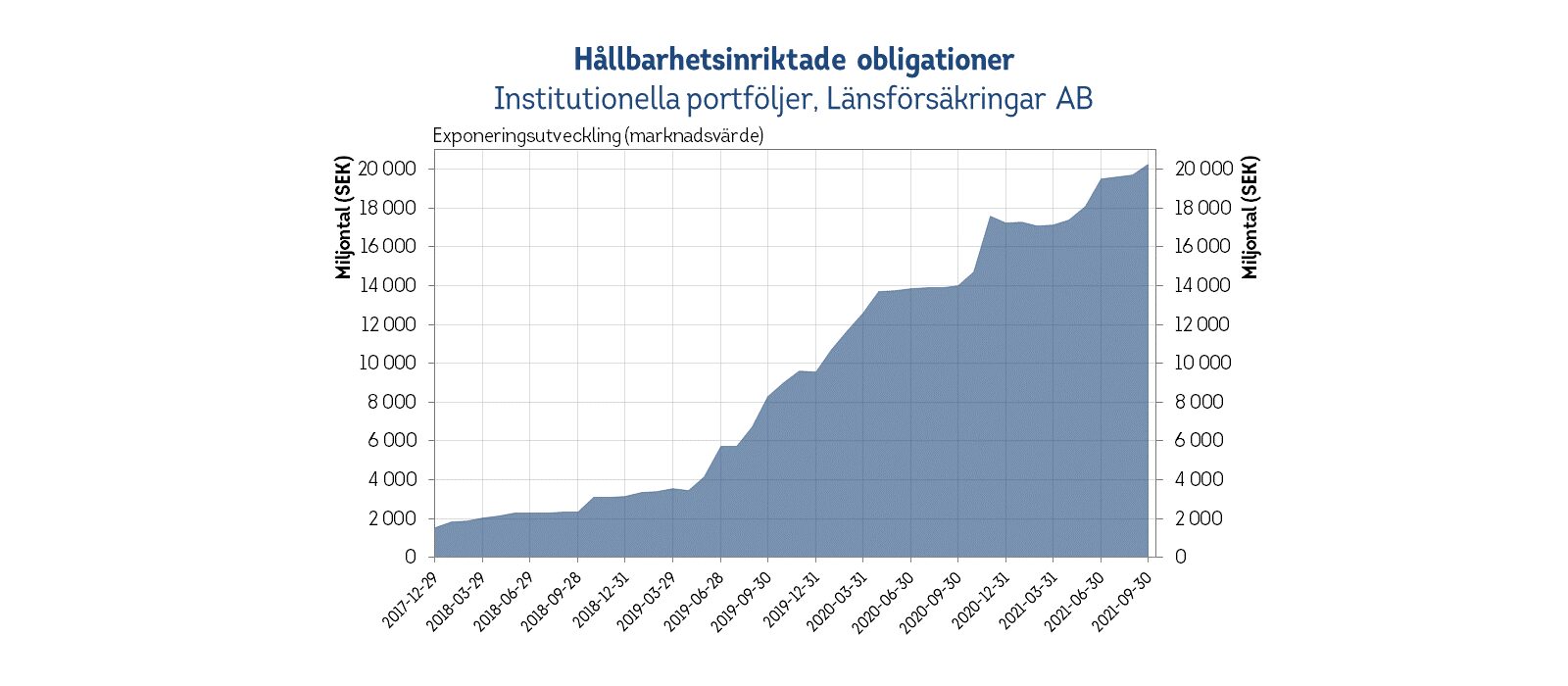

Swedish ICMIF member Länsförsäkringar has announced that its investments in green, social and thematic (“sustainability-oriented”) bonds, on behalf of customers, will reach more than SEK 20 billion in the third quarter of 2021. Since the beginning of 2018, the mutual insurer says that investments have increased tenfold and now correspond to more than 16 percent of the assets under management in the institutional life and insurance portfolios*. The investments are in line with Länsförsäkringar’s climate-smart vision.

Länsförsäkringar says the UN’s latest climate report indicates that the transformation of society in order to achieve the Paris Agreement’s climate goals needs to be accelerated. At the same time, the International Energy Agency (IEA) recently stated that investments in renewable energy need to be tripled by 2030 in order to achieve this climate goal. One way for Länsförsäkringar says it can contribute to the transition is to maintain a high rate of investment in sustainability-oriented bonds where funds are earmarked for projects with, among other things, positive climate effects and the expansion of renewable energy production.

“In a few years, we have managed to increase tenfold the investments in sustainability-oriented bonds by setting ambitious annual targets, focusing on direct investments and applying an integrated ESG and financial analysis within Länsförsäkringar Liv’s asset management. The investments are intended to contribute to both customer value and sustainable value creation,” says Kristofer Dreiman, Head of Responsible Investments, Länsförsäkringar Liv.

Dreiman continued: “Transparency in our work with sustainability-oriented bonds has been another success factor. We regularly publish and update a list of the institutional portfolios’ 30 issuers of sustainability-oriented bonds on our website.”

* Investments in sustainability-oriented bonds are made from the institutional life and insurance portfolios linked to Länsförsäkringar Liv, Länsförsäkringar AB with subsidiaries and Agria, as well as in the guarantee management for Fondliv.

Länsförsäkringar’s climate-smart vision

Investments in sustainability-oriented bonds are in line with Länsförsäkringar’s overall climate-smart vision. The vision means that its portfolios will touch a level of emissions in 2030 that is in line with the Paris Agreement’s goal of limiting global warming to 1.5˚C. In practice, this means that the CO2 footprint will be halved, compared with 2019 levels.