International Financial Reporting Standards (IFRS) were established to create a common accounting language so that businesses and their financial statements can be consistent and reliable, and that meaningful comparisons by company, country or industry can be made.

Issued by the International Accounting Standards Board (IASB), they specify how companies must maintain and disclose information in their accounts, defining types of transactions, and other events with financial impact.

After nearly 20 years of discussion, IFRS 17 – Insurance contracts, was published in June 2020 and will be implemented for reporting periods from January 2023.

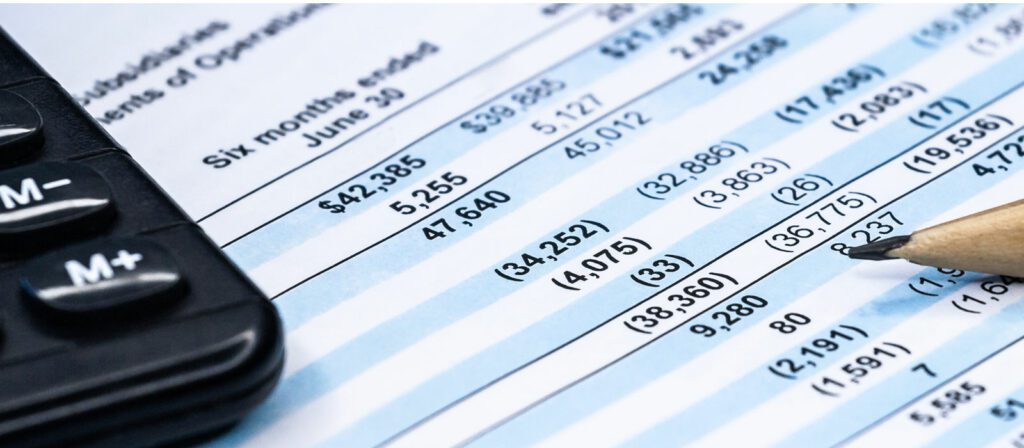

The impact and requirements of IFRS 17 will be felt across every part of the insurance value chain. IFRS 17, alongside the recognition of IFRS 9 for many companies, will impact aspects of insurer disclosure including the balance sheet, income statement, changes in equity, cash flow statement and extra explanatory information. The change will be significant for IFRS reporters because IFRS 17 goes requires greater granularity of data, with deeper cohort analysis. This will encompass greater actuarial valuation and data validation, a truer reflection of profit, asset liability management and risk management. Furthermore, companies will need to engage with both internal and external stakeholders on new financial metrics and terminology relating to the new standard.

IFRS 17 will have both operational and financial consequences for insurers, and the extent will largely depend on the policies they contract and the countries they operate in.

To better understand how insurers are adjusting their business practices with the expected transition in 2023, mutual insurers Mutua Madrileña (Spain) and Mútua dos Pescadores (Portugal) share their experiences and challenges so far in this webinar. The topic is introduced and commented by AM Best.

Speakers:

- Ramón Hernán, Consolidation and Technical Accounting Department, Mutua Madrileña Group (Spain)

- Ana Vicente, CEO, Mútua dos Pescadores (Portugal)

- Mahesh Mistry, Senior Director, Credit Rating Criteria Research & Analytics, AM Best (UK)