A new report on the landscape of mutual microinsurance in Kenya has been published today by the International Cooperative and Mutual Insurance Federation (ICMIF).

The report, entitled ICMIF country diagnostic report on mutual and cooperative microinsurance in Kenya, was written in partnership with Kenyan-based ICMIF member organisations CIC Insurance Group (CIC) and Takaful Insurance of Africa (TIA). Local researchers ACRE Africa and SBO Research were commissioned to carry out the research. The findings of this report demonstrate that Kenya has a thriving cooperative sector and they have given rise to an evidence-based strategy for the development of mutual microinsurance in the country as described in the report.

Over a third of Kenya’s population is considered to be poor, earning less than USD 2 per day (UN Human Development Report, 2016). The largest proportion of the country’s population comprises smallholder farmers, traders, manufacturers and people generating livelihoods on a small and generally vulnerable scale. However, the report suggests that Kenya has the potential to be one of Africa’s great success stories in addressing the challenges of poverty, inequality, and low investment which will be a major goal for the country and that this can be achieved, in part at least, through the provision of mutual microinsurance.

In July 2013 the World Council of Credit Unions (WOCCU) recognised Kenya’s savings and credit cooperative organisations (SACCOs) as the fastest growing subsector in the world. The report’s findings indicate that a large proportion of the target market for mutual microinsurance clients in Kenya are already members of these organised groups; almost a third of the potential target group belonged to SACCOs (27%).

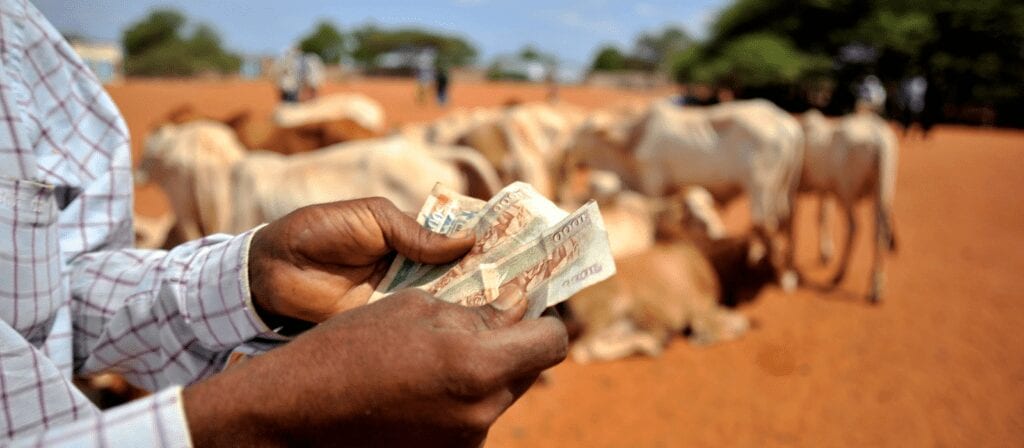

Further findings from the report indicate that only a small proportion of the target market for microinsurance (22%) demonstrated an awareness of what microinsurance is. The report also states that, when questioned, this target market state that the major risks they face include inability to pay school fees, high medical bills and loss of livestock.

Key recommendations of the country diagnostic report are to support the development of mutual microinsurance in Kenya through the following measures: increased demand for needs-based products for low-income earners; more insurance literacy initiatives; and scaling up of existing mutual insurers. The report also suggests insurers should partner with more intermediaries (such as cooperatives) in order to widen their reach, and leverage the trust and infrastructure of these intermediaries.

The findings of this report have been used to create an evidence-based strategy for the development of mutual microinsurance in Kenya by cooperative insurer CIC as launched in Nairobi on Monday 17 September (see news story).

Over the next five years, CIC plan to issue over 250,000 livestock microinsurance policies to previously uninsured low-income farmers, equating to 500,000 cows insured. CIC plan to scale up their previously existing livestock microinsurance product by partnering with dairy cooperative associations. CIC’s programme is being directly supported by ICMIF member companies P&V (Belgium) and Thrivent Financial (USA), as well as We Effect (head-quartered in Sweden) a non-profit organisation of which ICMIF member Folksam (also based in Sweden) is a founding partner.

The study was conducted as part of the ICMIF 5-5-5 Mutual Microinsurance Strategy, which aims to expand the reach of microinsurance delivered by mutual and cooperative insurers (“mutual microinsurance”) to help build resilience in poor communities by reducing their risk of poverty. The 5-5-5 Strategy is a five-year programme based in five emerging market countries (Colombia, India, Kenya, the Philippines and Sri Lanka) and aims to reach five million households with mutual microinsurance for the first time. It is a unique initiative which aims to build the resilience of low-income communities by ensuring the provision of low-cost microinsurance.