This week Dutch ICMIF member Achmea announced that it is in the top three of the most socially engaged Dutch insurers according to the Fair Insurance Guide (De Eerlijke Verzekeringswijzer). The announcement was made on Thursday 23 January 2020 following the Fair Insurance Guide’s annual survey of the investment policies of the nine largest insurance groups in the Netherlands. Achmea scored particularly well on health, employment rights, nature and arms and overall was ranked third. Achmea’s climate change score has risen from 4 to 6.

Along with a number of other financial institutions, Achmea made a commitment to the Dutch Climate Agreement in 2019. In the same year, Achmea announced that it would no longer be investing in businesses that generated more than 30% of their revenue from coal or from the extraction of oil from tar sands. In making this announcement, Achmea wanted to send a signal to the largest polluters that they needed to take action.

Five of the nine insurers surveyed scored only one “satisfactory” for their investment policy in the 21 categories of social issues on which the overall ranking is based.

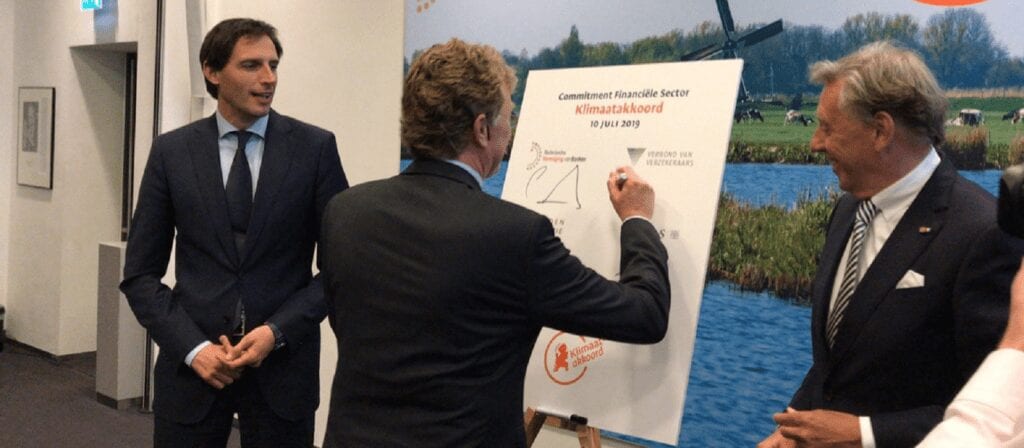

Willem van Duin (pictured), Chairman of Achmea’s Executive Board: “Achmea wants to contribute to a healthy, safe and future-proof society. That’s why I’m happy with our good scores in the Fair Insurance Guide, particularly when it comes to climate change. As an insurer, we are seeing an increase in the losses suffered by our customers as a result of extreme weather. Our investment policy aims to make a substantial contribution to the transition to a climate-neutral economy. In 2019, we took concrete steps in this direction. So, it’s great to see that our climate score in particular is up two points on last year’s score.”

Encouragement to do more

In spite of Achmea’s good performance, the organisation still believes that there is still scope to put its operations and investment policy on a more sustainable footing. Van Duin said: “We’re continuing to work hard to make a bigger social impact with our investments and our engagement programme plays an important role in this. We will use this programme to talk to companies and encourage them to make their operations more responsible.”

Achmea is a large insurer and pension fund manager and as such is a large investor. The company invests the funds it receives from its insurance operations, such as premiums, on a proprietary basis. In addition, it invests the assets that customers entrust to the company via Achmea’s own asset manager, Achmea Investment Management. These include the pension fund assets managed or the assets of customers’ investment accounts. Achmea invests the insurance premiums and pension contributions from its customers and as a group it manages assets of more than €140 billion.

The Fair Insurance Guide is a joint venture with Amnesty International, FNV, Milieudefensie, Oxfam Novib, PAX and World Animal Protection. The Fair Insurance Guide shows the extent to which the investments of insurers contribute to a socially just and sustainable world. The aim is to make the investment policy of insurers more sustainable and to align investments and business operations accordingly. The underlying aim is for insurers to use their financial and other influence to encourage the businesses in which they invest to contribute to a sustainable and socially just world.