The survival of motor mutuals will depend on their ability to leverage the advantages of their unique ownership model to retain market share, as demand for traditional motor insurance diminishes

Arguably, the biggest risk facing the insurance industry over the next 10 years is the emerging business risk to the motor insurance industry, as the way people get around and how they want to insure their travel are transformed by new technologies and evolving consumer behaviours.

Like the rest of the insurance industry, nearly one-third of the cooperative and mutual insurance sector’s premium income is written in the motor insurance market, according to a recent report by the International Cooperative and Mutual Insurance Federation (ICMIF).

It is clear our existing concept of insuring personal transport – buying a car and insuring it for a 12-month period – which has hardly changed for more than a century, is now heading towards extinction.

With a large number of cooperatives and mutuals heavily reliant on motor insurance, their future prosperity – indeed, their survival – will depend on their ability to retain market share as demand for traditional motor insurance diminishes by adapting their business model to meet the emerging demands of transport-related risks. These new demands are shaped by multiple factors, technological, social and in the way the insurance market operates is changing.

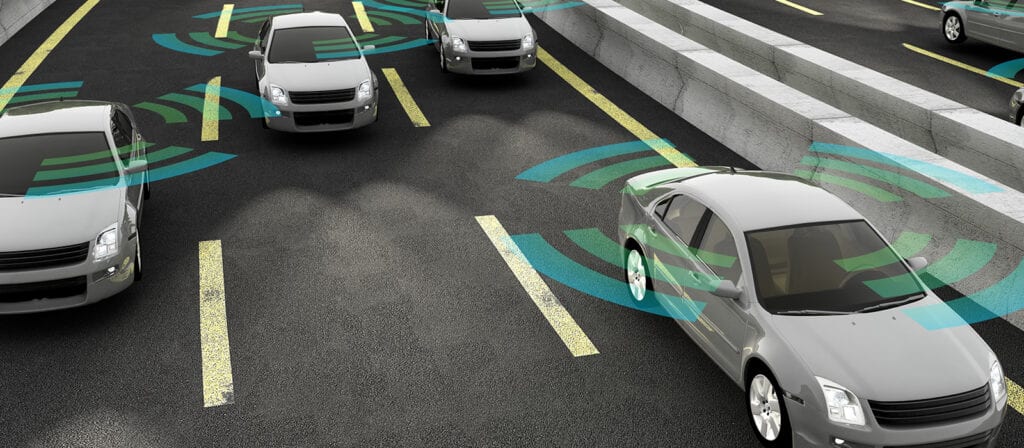

First, vehicle technology is being transformed like never before and the vehicles that are set to dominate our roads within the next 10 to 20 years are Aces – that is, automated, connected, electric and shared. An estimated $200bn has been invested in Aces vehicles since 2010, according to McKinsey.

Vehicles will no longer be driven, but rather ridden, and will be operated not by fallible humans but by sophisticated technology that links to sensors and controls in roadways and the surrounding infrastructure. These are far from cars as we have known them for more than 100 years.

Second, and more immediately, the sharing economy is transforming car usage and that is likely to accelerate. Today’s drivers can avoid the heavy financial cost of owning and maintaining a car by renting and can quickly get temporary cover through mobile app platforms like Cuvva.

That is particularly appealing for young drivers, some of whom may even be the first generation of insurance consumers who will never purchase an annual motor policy.

The underwriting challenge that presents is clear: writing cover for individuals whose risk data may be incomplete, who use vehicles that may change from one trip to the next and for a premium that is calculated for a single, unique journey.

Ownership model

That transition for mutual and cooperative insurers will, inevitably, be complicated by uncertainty about the necessary pace of change. This challenge is not unique to them, of course, but the ownership model of mutual businesses imposes an additional pressure.

On the one hand, tardiness to embrace change and a failure to respond to emerging needs as quickly as the competition may lead to a loss of business.

On the other, rapid, large-scale investments in technology that ultimately fail to deliver member value due to the pace of change (will today’s brilliant innovation become tomorrow’s obsolete legacy?) could well damage the relationships of trust that are, typically, strong between the cooperative/mutual and its member-owners.

These relationships of trust provide cooperative/mutual insurers with a sustainable competitive advantage. Those close relationships with members also offer a strategic advantage, as they can be leveraged (ie, through their affinity groups, member panels and so on) to develop an in-depth understanding of their members’ anticipated needs and thus identify how to balance immediacy and agility with sustainable strategies.

To date, the sector has followed a moderate, well-informed pace: innovation hubs are being created, investments have been made in start-ups, and concrete business partnerships have been established, to bring together the brightest technological thinking and this immensely experienced insurance sector.

Mutual insurers that form partnerships with platforms that enable sharing of cars and parking spaces or connect car owners and mechanics show strong signs of positive impact for their members and while these mutuals may seem at present to provide little more than a “new-tech” edge to “traditional” motor insurance, they nonetheless provide the insurer with invaluable experience in co-creating with the technology industry. Being among the forerunners of the emerging insurtech industry will almost certainly pave the way for the protection of transportation and mobility risks.

A predominant and recurrent theme for co-operative and mutual insurers – not just in relation to motor insurance – emphasises their expanding role as the providers of risk reduction and loss prevention rather than financial reimbursement.

That role will be essential as they manage the transition from traditional car-and-driver policies to Aces-and-user protection.

Risk prevention

It should be remembered that road risk prevention is an integral part of the business model, not just an add-on, for motor insurers within the cooperative/mutual sector; this should come as no surprise, given many leading mutual insurers were originally set up specifically to provide motor coverage to their founding affinity groups.

Across all regions, we can find cooperative and mutual motor insurers that provide a lot more than loss-related financial indemnity to their motor policyholders and whose loss prevention initiatives also benefit the broader community.

To name just a few: research findings from the road safety research laboratory set up several decades ago by Folksam (Sweden) has led to nationwide improvements in car safety, child seats and the treatment of whiplash injuries; Maif (France), Seguros Sancor (Argentina) and Zenkyoren (Japan) are just some of those that provide road safety tools for children and their teachers; NTUC Income (Singapore) offers free motorcycle safety training to its customers; virtual reality software developed by Achmea (Netherlands) helps children develop the skills they need for reaching school safely and securely.

But with so many options on the table for the entire industry, it will be crucial for cooperative/mutual insurers to maintain or further develop their close relationships with members, leverage the advantages presented by their unique ownership model and continue to reinvent themselves.

If they do so, the mutual insurance sector can look forward to the average age of co-operative/mutual insurers passing well beyond the 100-year mark, as they move from being the providers of motor insurance to providers of mobility protection. The relative longevity of the sector suggests it is adept at reinventing itself and ensuring it remains attuned to the needs of its customers.

This blog was originally written by Faye Lageu, Senior Vice-President – Business Intelligence, ICMIF, for and published by Insurance Day in a special feature on emerging risks (published 6 March 2019). The blog is reproduced here with the kind permission of Insurance Day.