For more information about the 5-5-5 and the work of The ICMIF Foundation, please visit the ICMIF Foundation website.

More than 700 million people, or 10% of the world population, live in extreme poverty, surviving on less than USD 1.90 per day.

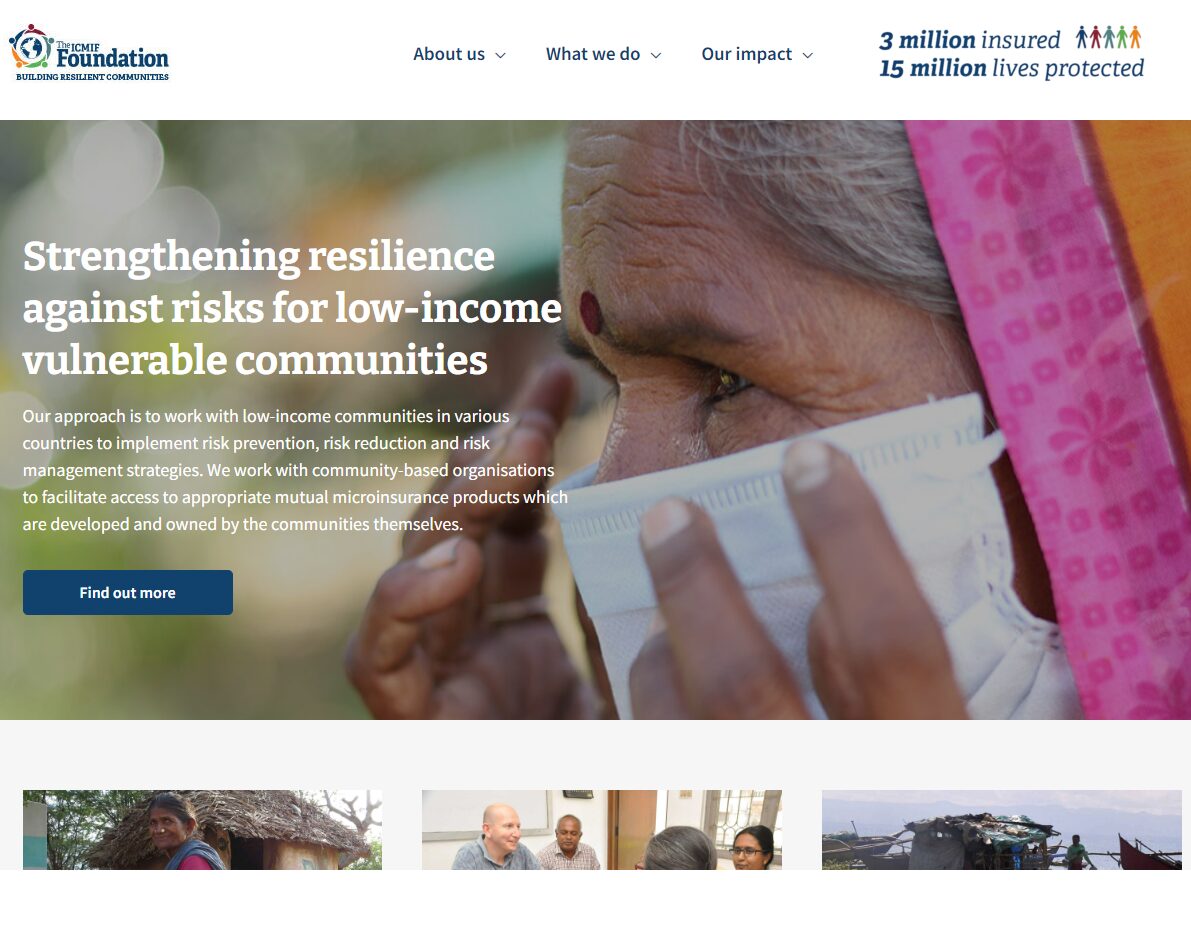

They live day to day, vulnerable to events completely out of their control, events which can cause complete devastation to their lives – illness, the death of a family members, a natural disaster. Climate change is exacerbating their vulnerability, making food security more precarious and the risk of a natural disaster higher. Seeing these challenges, The ICMIF Foundation, through its 5-5-5 Mutual Microinsurance Strategy “The 5-5-5”, is working to build insurable populations from low-income communities in emerging markets.

The ICMIF Foundation was established by ICMIF and incorporated in 2015 as a registered charity in England and Wales (No. 1179919), subsequently in 2016, the 5-5-5 Strategy was launched to provide low-income communities a safety net to prevent them from slipping into extreme poverty through the provision of microinsurance cover and other risk reduction measures.

As of 2020 through its projects in the Philippines, India and Kenya, the 5-5-5 Strategy issued 2 million policies to low-income households, protecting ten million individuals when averaging five people per household, and at a funding costs of just 0.74 USD per policy.

By supporting ICMIF members in emerging markets to scale up their microinsurance programmes, The ICMIF Foundation is enabling the mutual model to do what it does best and serve the needs of local communities.

Through the delivery of economic and social benefits to low-income communities, the 5-5-5 Strategy is aligned with the United Nations Sustainable Development Goals (SDGs). A recent report from the University of Cambridge Institute for Sustainability Leadership has, for the first time, analysed how mutual microinsurance, a community-owned model of insurance, contributes to the recovery of low-income households following a natural disaster. The report, looking at mutual microinsurance through the lens of the UN SDGs, indicates greater resilience for those households covered by mutual microinsurance than those without and 14 SDGs impacted.