Singaporean ICMIF member NTUC Income (Income) recently announced the launch of Pinfare, an innovative, travel-inspired lifestyle insurance by Digital Income, the company’s in-house Digital Transformation Office (DTO). Pinfare seeks to address one of the most common pain points for travellers – the pressure of having to purchase a desired flight itinerary on-the-spot, or be subjected to unpredictable […]

Read MoreCanadian ICMIF member The Co-operators is further expanding its Insurtech investment by introducing a fund to facilitate partnerships with Insurtech firms. The Co-operators says that the investment fund reflects the organisation’s commitment to address the unmet insurance and financial services needs of Canadians participating in a fast-paced and ever-changing digital economy. “Innovation is key to providing financial […]

Read MoreWhether they have made a claim on their policy or not, members of Swiss ICMIF member La Mobilière will this year receive CHF 160 million (USD 160 million) from the cooperative insurer. In their announcement this week, La Mobilière says that theirs is not an insurance company like many others. Thanks to the cooperative nature of the […]

Read MoreGerman ICMIF member HUK-COBURG announced the launch of “Telematik Plus,” its new telematics insurance program for drivers of all ages. With more than 12 million insured vehicles, HUK-COBURG are Germany’s largest car insurers. “Over the last few years, we’ve built an entire telematics infrastructure, thus laying the groundwork for the product we are now offering […]

Read MoreIt has been announced today that the Australian Federal Parliament has passed landmark legislation for mutuals. These are the first amendments to the Corporations Act for 18 years that relate to the cooperative and mutual sector and open up a number of new opportunities for Federally registered cooperatives and mutual businesses in Australia to grow […]

Read MoreCanadian National Insurance Crime Services (CANATICS) has this week announced the appointment of Denis Dubois (pictured) as the new Chair of its Board of Directors. CANATICS is a non-profit organisation focused on fighting insurance crime. Dubois is the President and COO of ICMIF member Desjardins General Insurance Group, Canada’s third largest property and casualty insurer […]

Read MoreAccording to the latest 1st View renewals report from ICMIF Supporting Member, Willis Re, reinsurers have adopted a rational rating approach at the 1 April 2019 renewal with price increases of up to 25% targeted towards loss-affected contracts and programmes. These rate increases were balanced by flat renewals for loss-free classes and programmes, says the report. Reinsurance broker […]

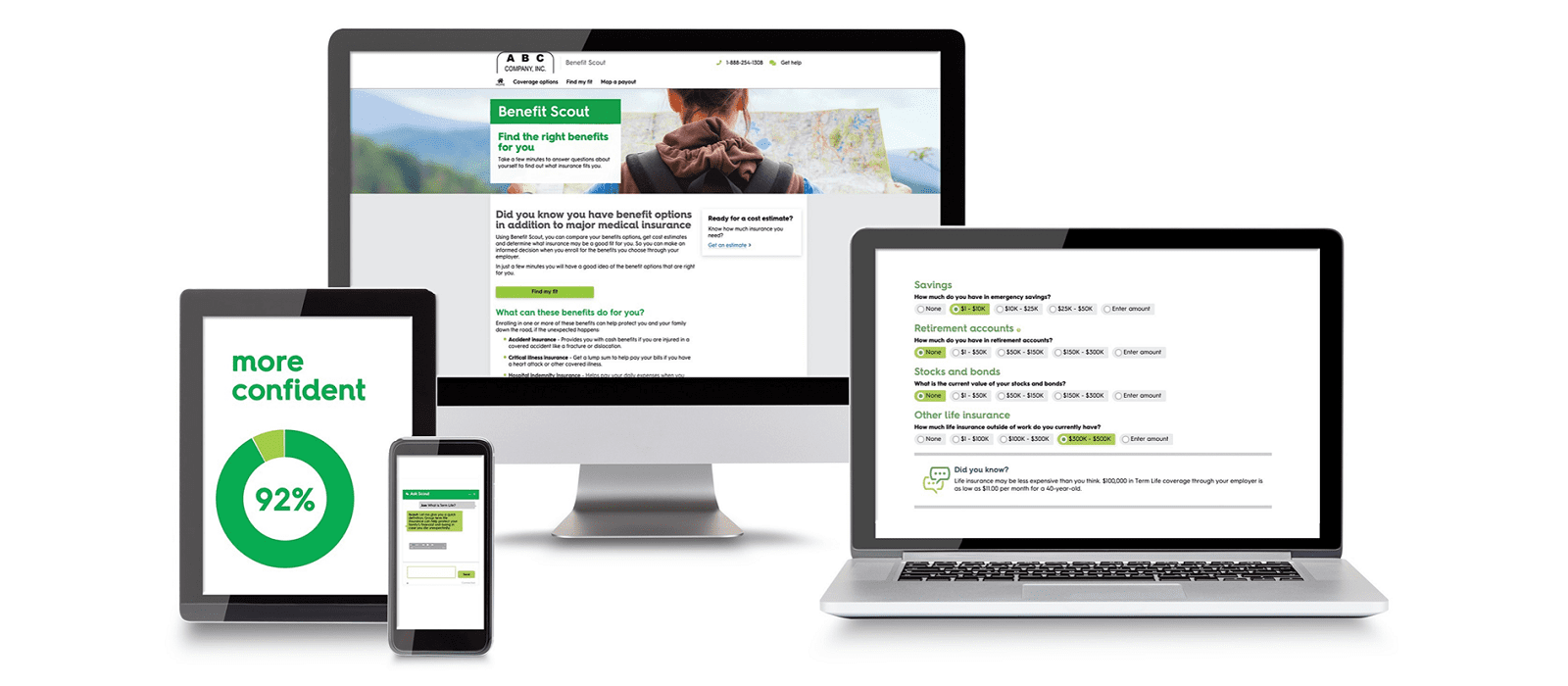

Read MoreUS ICMIF member Securian Financial has launched a customer focused decision-support experience to educate employees about the voluntary benefits the insurer offers through employers. Called Benefit Scout™, the interactive, digital platform leverages artificial intelligence to guide employees step-by-step through the decision journey. The result is less guesswork for employees—and fewer questions for human resources staff—during […]

Read More