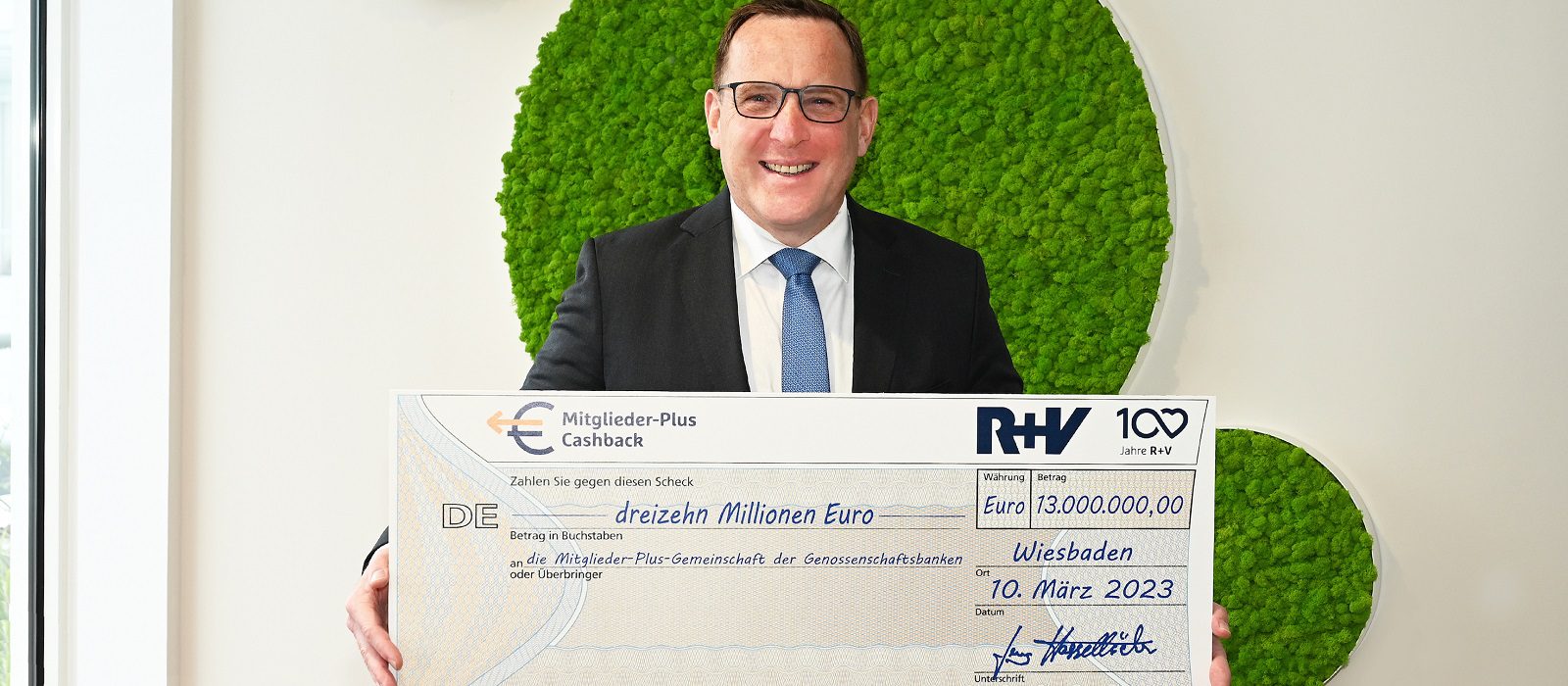

The cashback programme of German ICMIF member R+V Versicherung rewards members of cooperative banks who have concluded a Member-Plus contract. The programme was launched in 2020. If the Member-Plus community of a cooperative bank has a favourable claims experience, then R+V Versicherung reimburses up to ten percent of the insurance premiums which is paid back […]

Read MoreICMIF member the Japan Cooperative Insurance Association Incorporated (JCIA) has recently published the English version of its annual Kyosai in Japan Fact Book. JCIA is a general incorporated association in Japan, which was established for the purpose of promoting coordination among member societies and contributing to the development of cooperatives and cooperative insurers. The main […]

Read MoreIn its 2022 financial results announcement this week, UK ICMIF member Royal London reported that it had added a total of GBP 675m over the last two years to its long-standing customers’ policy values as a result of its closed with-profits fund consolidation programme, which is now complete. The mutual insurer also announced that its […]

Read MoreFoundera, a new subsidiary from Swiss ICMIF member La Mobilière, offers all the services needed to become professionally independent and to set up a company. The subsidiary was developed to help people navigate the numerous questions that arise on the path to professional independence. For example, entrepreneurs have to decide which legal form to choose, […]

Read MoreEarlier this year, ICMIF member Thrivent (USA) announced that it will distribute USD 400 million in dividend payments and credited rate enhancements to its clients in 2023. This year’s dividend payout marks a 37% increase over 2022, signifying how Thrivent is continuing to return value to its clients. As a not-for-profit, fraternal benefit organisation, Thrivent […]

Read MoreFollowing increasing numbers of severe thunderstorms, heavy rain or floods in Germany and in order to protect its customers from the consequences of extreme weather, ICMIF member R+V Versicherung (R+V) has significantly expanded its insurance cover for natural hazards. Climate change is increasing the risk of severe storms and R+V says no region is safe […]

Read More