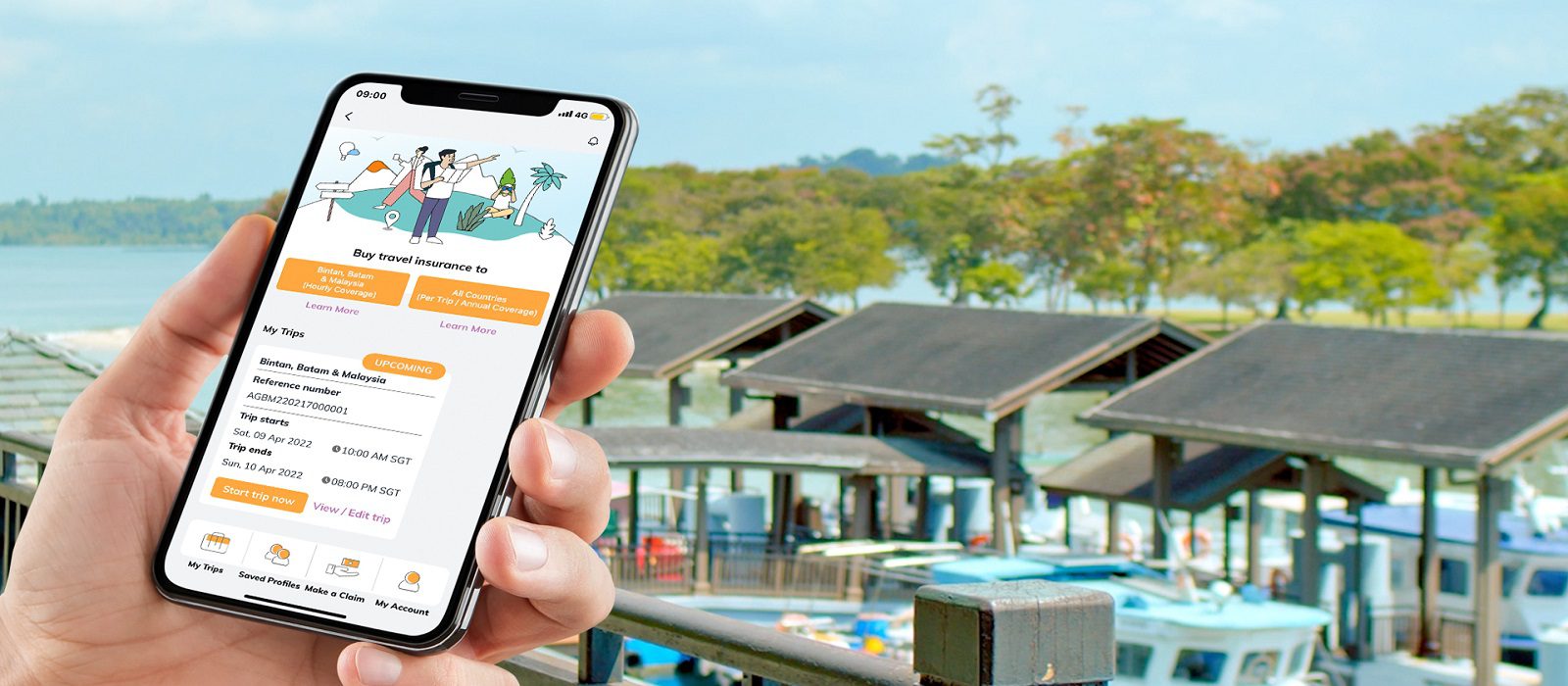

ICMIF member NTUC Income (Income) has launched FlexiTravel Hourly Insurance, Singapore’s first travel insurance that enables travellers to purchase travel protection as needed by the hour. Available for those who are travelling only to Bintan, Batam and Malaysia, FlexiTravel Hourly Insurance is a flexible and affordable way for travellers to insure themselves for short or […]

Read MoreGerman ICMIF member HUK-COBURG is now offering its telematics customers automatic accident detection for quick support in the event of an accident. If the telematics system detects a possible traffic accident within Germany, users receive a push message on their smartphone. Depending on the severity of the accident, help can be requested by the member […]

Read MoreA new special report from ICMIF Supporting Member AM Best sets out the rating agency’s current thinking on how it will treat the IFRS 17 accounting standard in the context of the insurance industry’s progress toward its implementation next year. The Best’s Special Report, IFRS 17: Transitioning to a Standard with New Concepts and Terminology […]

Read MoreICMIF Supporting Member Gallagher Re has published its Global InsurTech Report for Q1 2022. The theme for this year will be ‘Geographic Trends and Regional Idiosyncrasies’, with this first report for 2022 taking a specific look at ‘the Americas’ through an InsurTech lens. As well as profiling various InsurTech businesses, clients and individuals, the report […]

Read MoreICMIF member The Wawanesa Mutual Insurance Company’s (Wawanesa) new Broker Platform is now live across Canada, making it easier for independent insurance brokers to access tools and resources from Wawanesa. “Independent insurance brokers are essential members of our community, helping Canadian families, farms and businesses protect their most important assets,” said Wawanesa’s EVP & President […]

Read More