Insurance companies in Europe and Asia Pacific are at different stages of their journey to integrate environmental, social and governance (ESG) factors into their businesses, according to new research conducted by ICMIF Supporting Member AM Best.

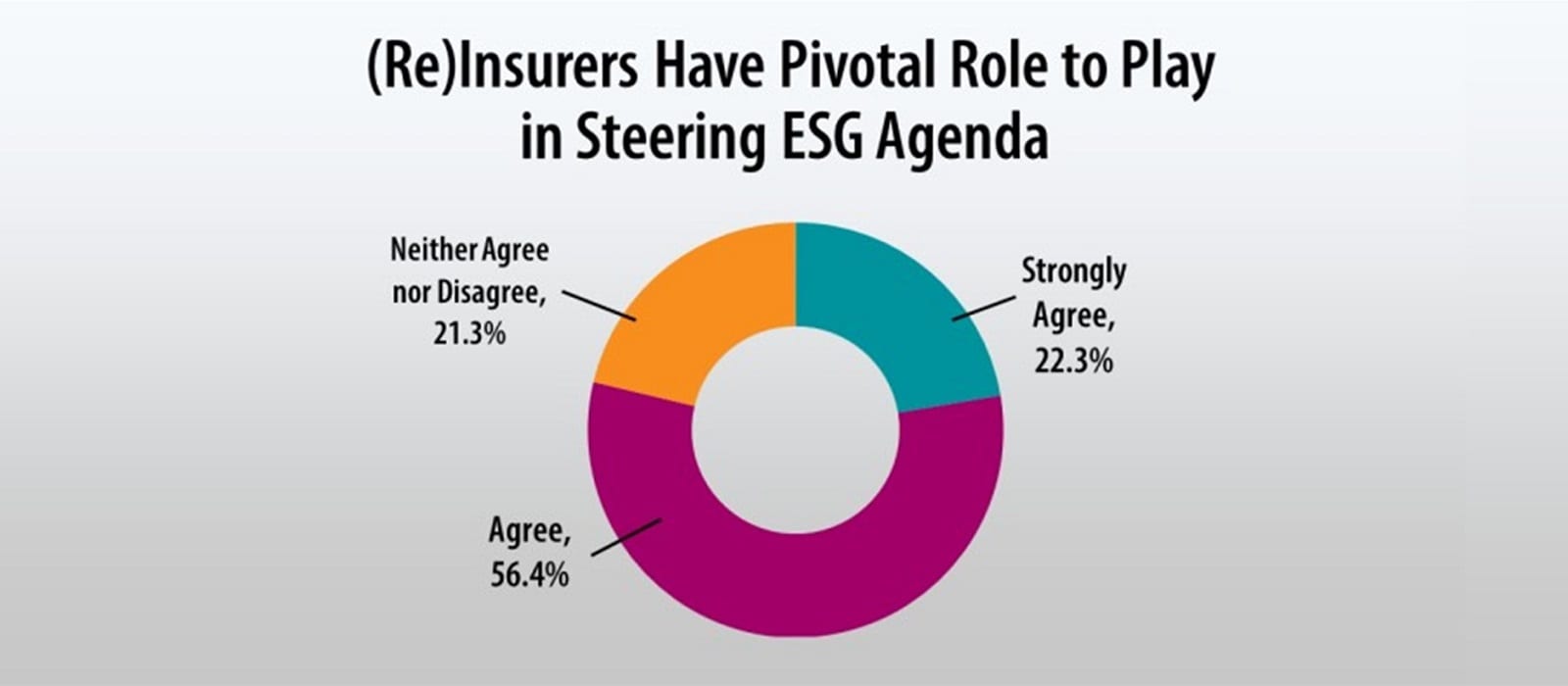

A new Best’s Special Report “Insurers and Reinsurers: Ignoring ESG Factors Poses Reputational Risk”, outlines the findings of a survey of nearly 100 insurance and reinsurance companies, which shows that a large majority of respondents recognise that proper understanding and integration of ESG factors is increasingly critical to the long-term viability of their businesses. However, overall there is a marked lag between recognition of ESG risks and action being taken to mitigate those risks.

Awareness of ESG factors has increased significantly, along with an acknowledgement that these factors require special attention, notes the report. Insurers and reinsurers occupy a unique position in the ESG space, as both risk carriers and institutional investors. Therefore, ESG factors have the potential to affect both sides of their balance sheets and impact their results, throwing the spotlight on the importance of integrating them in to underwriting and investment activities.

In general, the survey respondents acknowledged that failure to act on stakeholder pressure around ESG issues could lead to long-term reputational challenges for their organisation and the insurance industry at large.

Larger respondents were more likely to make the link between failure to act and the longer-term reputational consequences. Reducing reputational risk was the most-cited reason behind integrating ESG factors in investing mandates by survey respondents.

Other findings from the survey include:

- In the main, investment activities are the primary focus of ESG integration, with only a few respondents highlighting underwriting initiatives.

- Corporate governance, product liability including cyber security, and climate risk are cited as the most relevant ESG issues for the insurance industry.

- Lack of transparent and comparable definitions and data is stifling greater application of sustainable investing practices.