A new special report from ICMIF Supporting Member AM Best sets out the rating agency’s current thinking on how it will treat the IFRS 17 accounting standard in the context of the insurance industry’s progress toward its implementation next year.

The Best’s Special Report, IFRS 17: Transitioning to a Standard with New Concepts and Terminology confirms that AM Best does not expect the introduction of the new standard to have a direct impact on Credit Ratings in the normal course of events. However, it notes that new insights can emerge over time and behavioural changes can occur that might affect ratings.

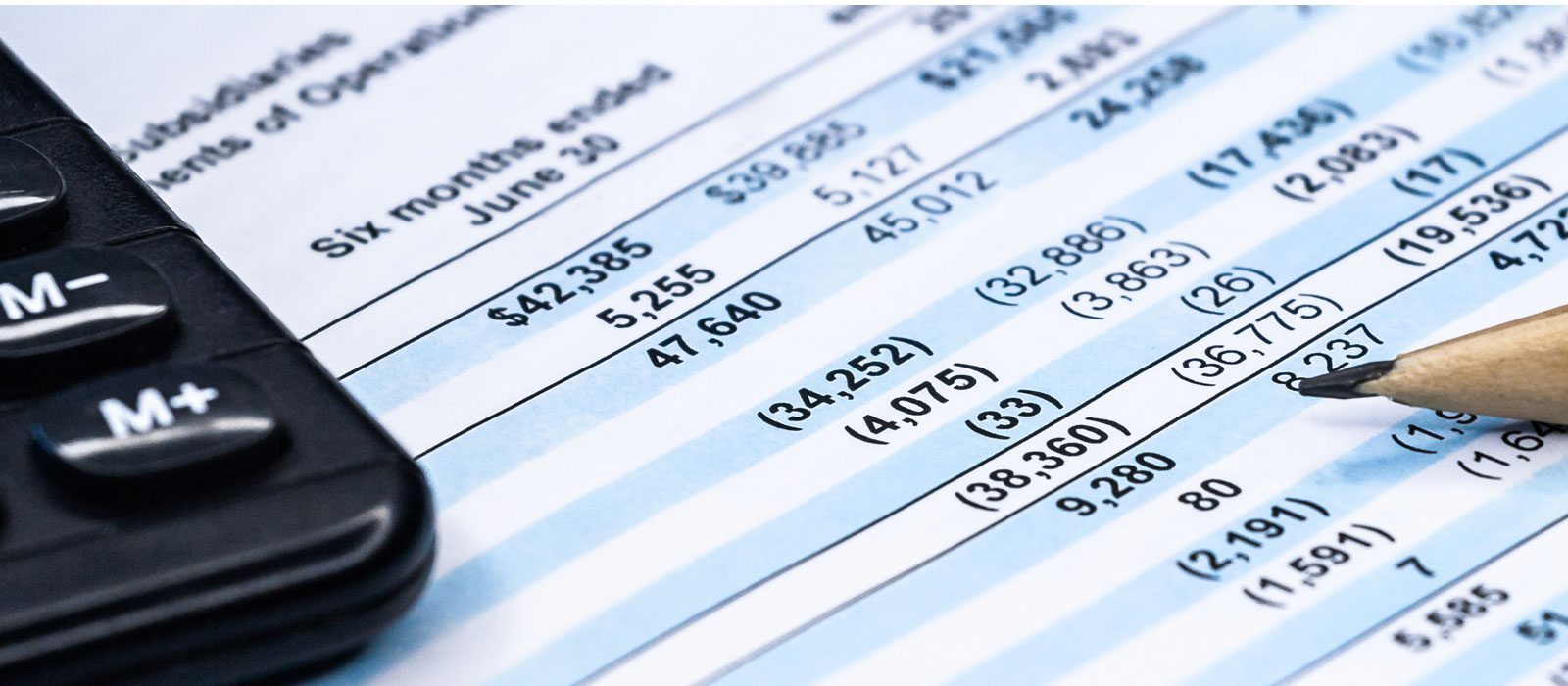

The report discusses some of the key performance indicators (KPIs) that the rating agency may use and some of the inputs to its proprietary capital adequacy model—Best’s Capital Adequacy Ratio (BCAR). Subjects covered include the calculation of combined ratios under IFRS 17 and the treatment of the contractual service margin in BCAR. AM Best anticipates that industry decisions on KPIs, along with other aspects of IFRS 17 implementation, will evolve, and that it may take two or three years of experience after the effective date for practice to settle.

AM Best will continue to have an economic view of (re)insurers’ balance sheets to cater for different reporting standards across jurisdictions. Maintaining that consistency, along with the comparability of financial metrics calculated under different reporting standards, will be a key objective when analysing (re)insurers that report under the new standard.

To access a complimentary copy of this special report, please visit http://www3.ambest.com/bestweek/purchase.asp?record_code=319469

AM Best will moderate an upcoming ICMIF webinar on IFRS 17 – A European mutual’s perspective on the benefits and challenges on 12 July 2022 (3pm BST). The webinar will look at the impact and requirements of IFRS 17 across the insurance value chain and the operational and financial consequences for insurers. Mahesh Mistry, Senior Director, Credit Rating Criteria Research & Analytics, will represent AM Best and will introduce and comment on the topic during the webinar.