During the first quarter of 2020, Swedish ICMIF member Länsförsäkringar introduced exclusion criteria for online gaming companies, which meant that 20 companies were added to the company’s exclusion list for investments. Now other types of gaming companies, which generate revenue from gambling for money, have also been excluded, which resulted in the removal of another 28 companies. The exclusion has been made in both the traditional portfolios and in the funds.

The decision was based, among other things, on a survey carried out by the Swedish Public Health Agency, which shows that commercial online gaming companies are the companies that contribute most negatively to increased problem gambling and gambling addiction. The survey also showed that many commercial online gaming companies violate licensing rules regarding, among other things, moderation in advertising from time to time.

“Based on the state of knowledge about the negative social and health-related effects and the industry’s sustainability risks, it feels well balanced to exclude the online gaming companies in all our own institutional portfolios linked to both Länsförsäkringar Liv, Fondliv and Sak for the time being. The criteria for online gaming companies is another step towards more sustainable and responsible saving for our customers,” says Kristofer Dreiman, Head of Responsible Investments in Asset Management at Länsförsäkringar Liv.

This summer, more companies offering casino games, slot machine games and tournament card games (eg poker) were excluded. These forms of gambling also contribute to high problem gambling and gambling addiction, although not as extensively as online gambling. The Swedish Gaming Inspectorate also published a risk assessment for money laundering during March this year. That report examined the Swedish gaming market, but Länsförsäkringar says there are overlapping sustainability risks in a global perspective, which have also been mapped in other studies.

“The risk of gambling being used for money laundering is considered to be greatest for commercial online gambling and casino gambling. This is mainly due to the fact that these forms of gaming offer the opportunity for high stakes and winnings and have a high turnover. So also getting rid of these types of investments in the funds we offer is a step forward in our work with responsible investments,” says Sofia Aulin, Sustainability Manager at Länsförsäkringar Fondförvaltning.

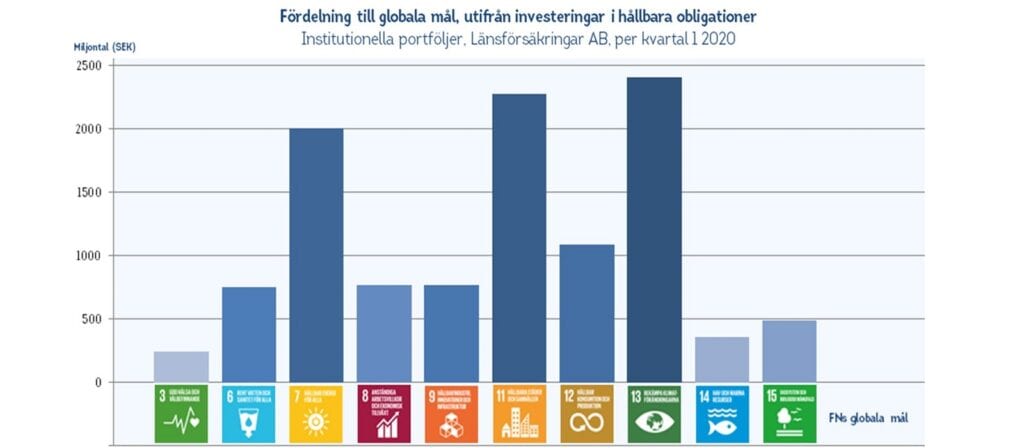

Länsförsäkringar applies various sustainability criteria for individual sectors and products in order to reduce the sustainability risks of portfolios and funds and contribute to sustainable value creation, including selected United Nations Sustainable Development Goals (UN SDGs). Among others excluded are:

- Mining and energy companies that have more than 5 percent of sales from coal, with the exception of selected energy companies that are judged to be in transition. Investments can be made in energy companies that have up to 20 percent of the turnover from incineration coal if the companies have set targets in accordance with the Paris Agreement and / or the turnover from renewable energy exceeds the turnover from fossil fuels.

- Companies whose turnover from unconventional oil and gas extraction (for example oil sands) exceeds 5 percent

- Manufacturers of tobacco products, companies involved in controversial weapons and companies that seriously violate international conventions and despite dialogue do not develop in the right direction; and

- States that overall are not considered to meet the basic criteria of human rights, democracy, and anti-corruption; as well as states / jurisdictions that the European Union deems uncooperative in the field of taxation.