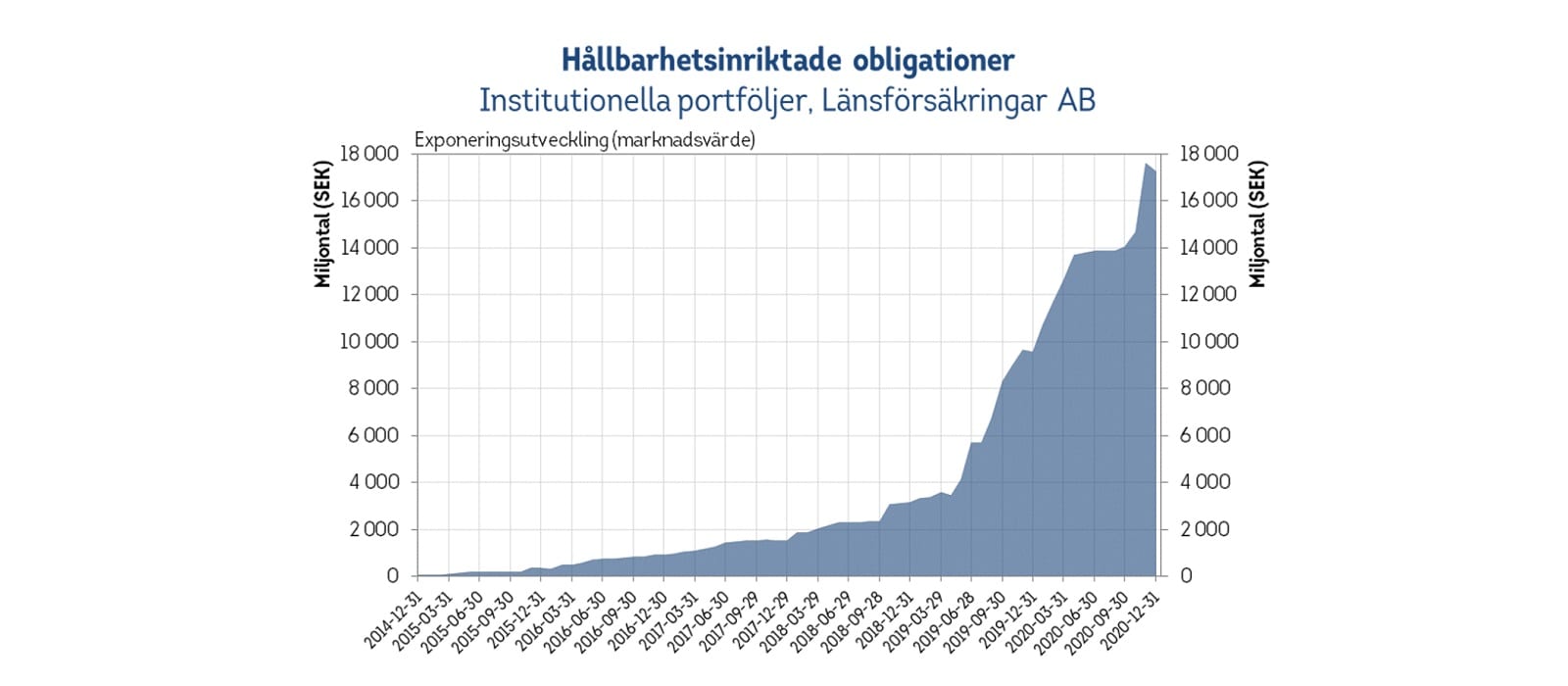

Swedish ICMIF member Länsförsäkringar‘s investments in green, social and thematic (“sustainability-oriented”) bonds on behalf of its customers increased by approximately SEK 7.5 billion in 2020. Investments at the turn of the year amounted to more than SEK 17 billion, which corresponds to more than 13 percent of assets under management in institutional life and the insurance portfolios*.

“The proportion of assets under management that are invested in sustainability-oriented bonds continues to increase and reached our annual target of at least 13 percent. The rate of increase is proof of how well integrated our ESG and financial analysis are in strategic allocation and in management in general. The investments are in line with our climate-smart vision and ambition to contribute to sustainable value creation and customer value,” says Kristofer Dreiman, Head of Responsible Investment at Länsförsäkringar Liv.

Of the approximately SEK 17 billion in sustainability-oriented bonds, Länsförsäkringar Liv’s investments accounted for approximately SEK 14.5 billion, which corresponds to 14 per cent of the life portfolios’ capital.

The growth in 2020 was possible thanks to a focus on direct investments in the primary market and a close dialogue with the issuers of bonds, which was of particular importance during the start of the Covid-19 pandemic. Together with industry colleagues, capital was mobilized, and investments were made in socially-oriented bonds with the aim of mitigating the health and economic effects of the pandemic, both locally and globally.

A complete list of the institutional portfolios’ 30 issuers of sustainability-oriented bonds is available at lansforsakringar.se (pdf)

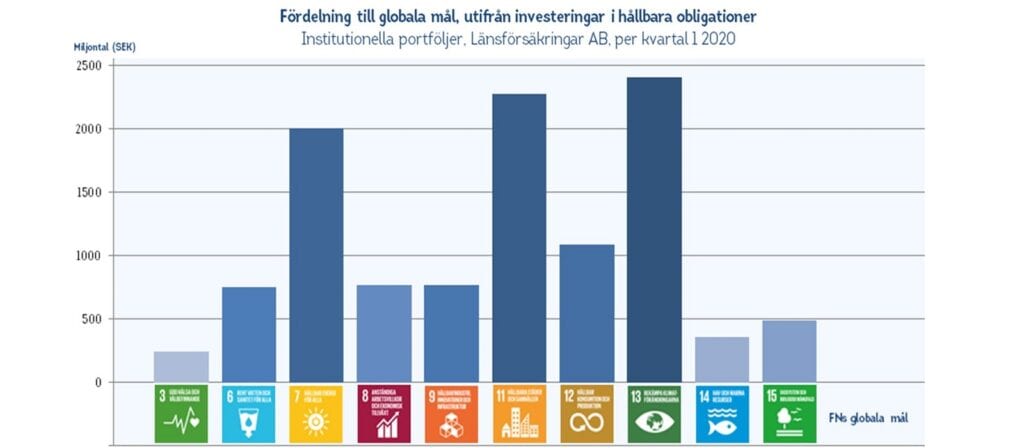

Of the investments, most money has been allocated to United Nations Sustainable Development Goal 13 “fighting climate change” followed by Goal 11 “sustainable cities and communities” and Goal 7 “renewable energy”.

“During the year, we systematically evaluated the sustainability effects of the financed projects thanks to better data from individual issuers. The evaluation was made in order to optimise the sustainability effects of the portfolios. With the supplementary data, as part of our integrated ESG and financial analysis, certain green bonds have been sold, primarily in the real estate sector. The potential to contribute to sustainable value creation was judged to be greater by making certain changes,” says Kristofer Dreiman.

* Investments in sustainability-oriented bonds are made from the institutional life and insurance portfolios linked to Länsförsäkringar Liv, Fondliv, Sak med subsidiaries and Agria.