ICMIF member and Singapore-based insurer NTUC Income (Income) has become the latest cooperative/mutual insurer to offer a “Pay-as-you-drive” motor insurance policy. The insurance product has been launched in partnership with Carro, the largest automotive marketplace in Singapore.

The new insurance product is based on a “pay as you drive” model and users will pay according to how much they drive the car. The less people drive, the less they pay and vice versa. Carro car subscription customers will benefit from insurance savings via subscription credits based on how much they drive. Rebates for un-driven distance will be used to offset subscription fees for the following month.

The new insurance service from Income uses vehicular telematics to assess how much each of their cars is driven in a single month and the data is then used to calculate the exact premiums.

“We recognise that while drivers own their cars, they may not be using them 24 hours a day, every day. With our usage-based insurance policy, we want to go the extra mile by calculating premiums based on how much they actually drive,” said Aaron Tan, founder and CEO of Carro.

“We are confident that our usage-based insurance will allow many drivers to enjoy savings, convenience and hassle-free experience through a trusted platform. Carro is proud to work with NTUC Income to extend this scheme to the wider pool of Singaporean car owners.”

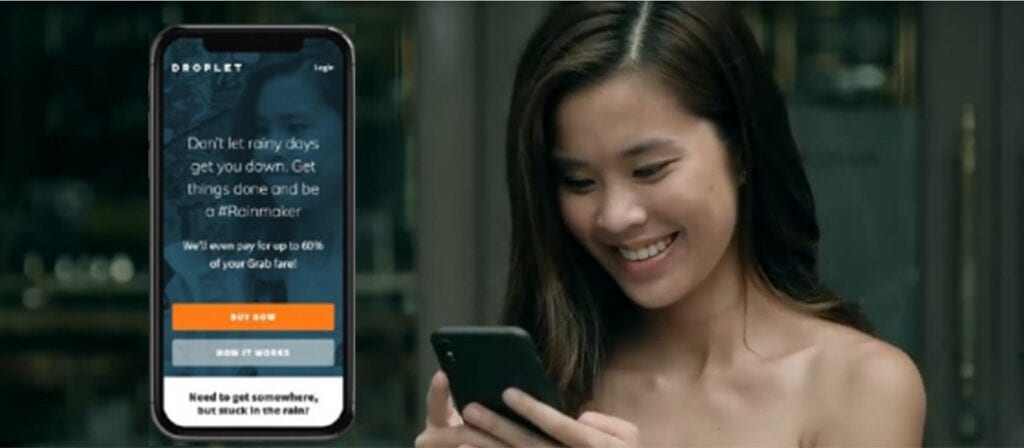

This is another customer-focussed product innovation from the team at Income, following their earlier “lifestyle insurance” products Droplet and Pinfare which were both developed by Digital Income – the company’s in-house Digital Transformation Office (DTO) – and a pay-per-trip microinsurance proposition for critical illness cover for Grab drivers – both great examples of how Income says the organisation is reimagining insurance protection based on their cooperative values, responding to changing customer needs and extending the accessibility of insurance to people in Singapore.