The current investment environment is experiencing turmoil due to high inflation, geopolitical issues, and catastrophe losses, impacting insurers and reinsurers. The failures of banks like Silicon Valley Bank and Signature Bank have further strained the market, affecting insurers' balance sheets. To address these issues, insurers have three methods: raising capital, improving cash flow matching, and using reinsurance. Reinsurance is an effective tool to manage volatility and improve capital ratios, helping insurers achieve their financial and strategic goals in these challenging times.

Macroeconomic environment

The investment environment is currently in turmoil. High inflation in many countries, driven by both supply-side and demand-side factors, has compelled central banks to raise interest rates in response. Interest rate hikes then flow directly into asset valuations. Additionally, recessionary expectations, the banking crisis and geopolitical issues are currently creating havoc in asset markets.

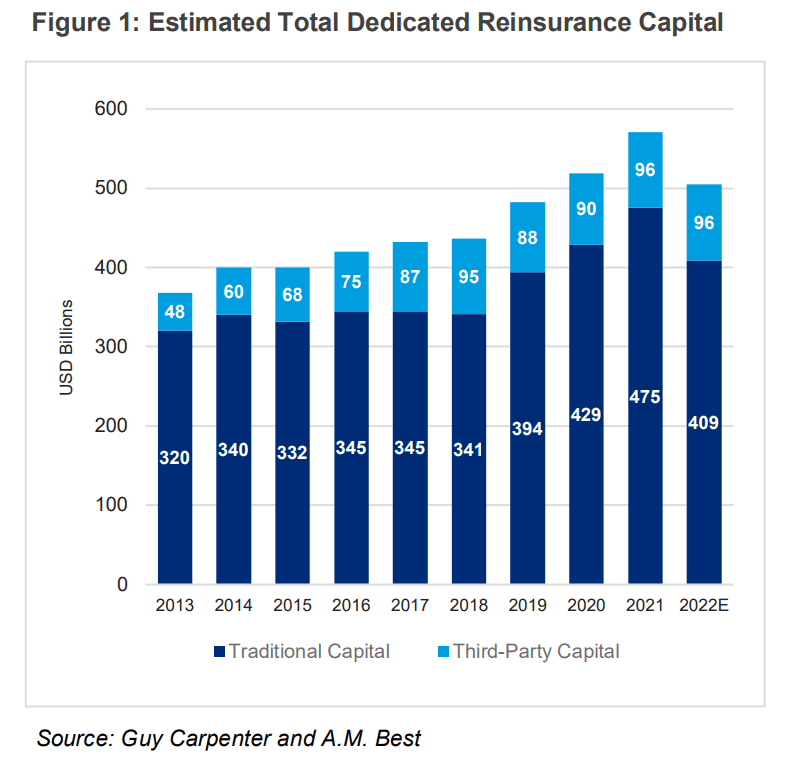

These issues largely impact insurers and reinsurers through increasing costs (both direct operating and claim costs, some through imported inflation) and declining asset prices on investment holdings. This impact has resulted in an increase in earnings volatility and reduction in capital (Figure 1).

The failures of Silicon Valley Bank (SVB) and Signature Bank may represent a weakness in the US banking industry and have led to the heavily discounted rescue of Credit Suisse by UBS. Such shocks may further reduce available capital in the market, impacting the balance sheets of insurers that hold investments issued by global banks while reducing the ability to raise new funds.

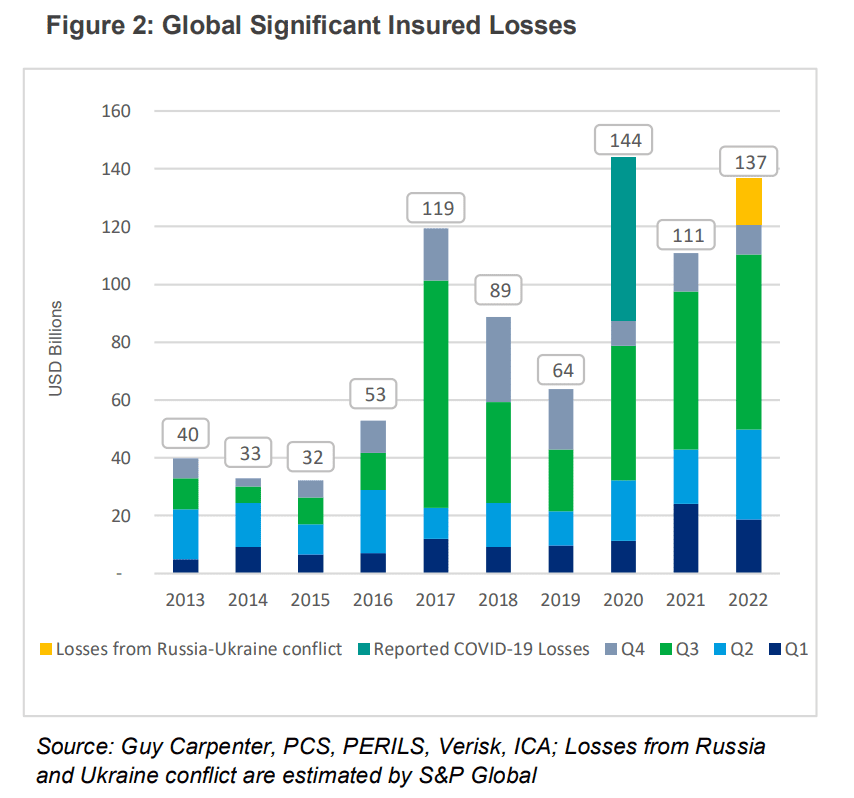

Additionally, growing catastrophe losses (Figure 2) and lower investment returns have led to industry-wide reductions in capital, resulting in a hardening market and pricing concerns for reinsurers. As a result, most insurers have increased retentions, which will ultimately lead to greater retained earnings volatility.

This article has been reproduced with the kind permission of Guy Carpenter.

Contacts:

Matthew Rose, Head of Life & Capital, Asia Pacific

Hussain Ahmad, Head of Structured Solutions, Asia Pacific

Philip Doyle, IFRS 17 Lead, Strategic Advisory, Asia Pacific

The original article Optimizing capital in volatile times: how reinsurance enables strategic risk management can be found here.

Published July 2023

Risk-based capital

Regulators in the Asia Pacific region are updating their standards to tighten and recalibrate available capital, leading to shifts in regulatory capital. Regulators in Japan, Korea, China, Malaysia and Hong Kong are among those introducing or updating risk-based capital standards in the region.

These changes are designed to make the capital regimes in these countries more responsive to risks. Such changes are meant to create a stable industry in the medium term, but in the short term, insurers may need to raise capital to meet the new standards.

Transition to IFRS 17

The transition to International Financial Reporting Standards 17 (IFRS 17) represents an evolution in financial reporting, but also has greater knock-on impacts, such as day-1 transition implications on available capital for risk-based capital and dividend issuance potential. Further, requirements for poorly performing businesses may result in greater earnings and capital volatility–insurers will have to recognize losses up-front for loss-making business groupings. IFRS 17 will be adopted in many jurisdictions in Asia-Pacific beginning in 2023, with others following from 2024 to 2026. Regulators in the region are also assessing the impacts of IFRS 17 to their risk-based capital standards, with some, such as Malaysia, already appearing to integrate IFRS 17 into future versions.

Long-tail claims

Long-tail claims remain problematic for many insurers. As the cost of debt and equity increases, insurers must maintain sufficient asset and investment capital for expected settlements. Without alternative capital relief solutions, insurers in the current operating environment will be unable to use that capital to generate greater returns.

In many countries, long-tail portfolios have been underperforming across the entire industry. While the longer[1]term solution will be to increase pricing for these classes of business, the imminent introduction of IFRS 17 and new capital standards suggest that many insurers will experience short-term volatility and capital strain.

Solutions

To manage the increased likelihood of greater short- to medium-term earnings volatility and an increased necessity for capital, insurers have traditionally used 3 methods to address the need for future capital:

1. Raising capital

This action solves capital needs but has limited impact on earnings volatility. Depending on the type of capital, for example, subordinated debt, this method reduces available earning for shareholders and thus limits ability to pay dividends. Further, raising capital is a long process, requiring the involvement of 3rd parties and roadshows. In particular, funds from equity are considered to be inefficient for taxation purposes. This method is a common practice in many Asian countries, but due to analyst focus on capital efficiency and dividend-paying ability, should only be used when solvency ratios are at or below target levels.

2. Improved cash flow matching–asset liability matching

While usually an effective strategy for life insurers, in times of market dislocation, as seen in the current investment market, hedging costs is now more expensive than ever. Hence, it is not a cost-effective strategy in the longer term. This method also does not solve the onerous contracts issue in IFRS 17.

3. Reinsurance

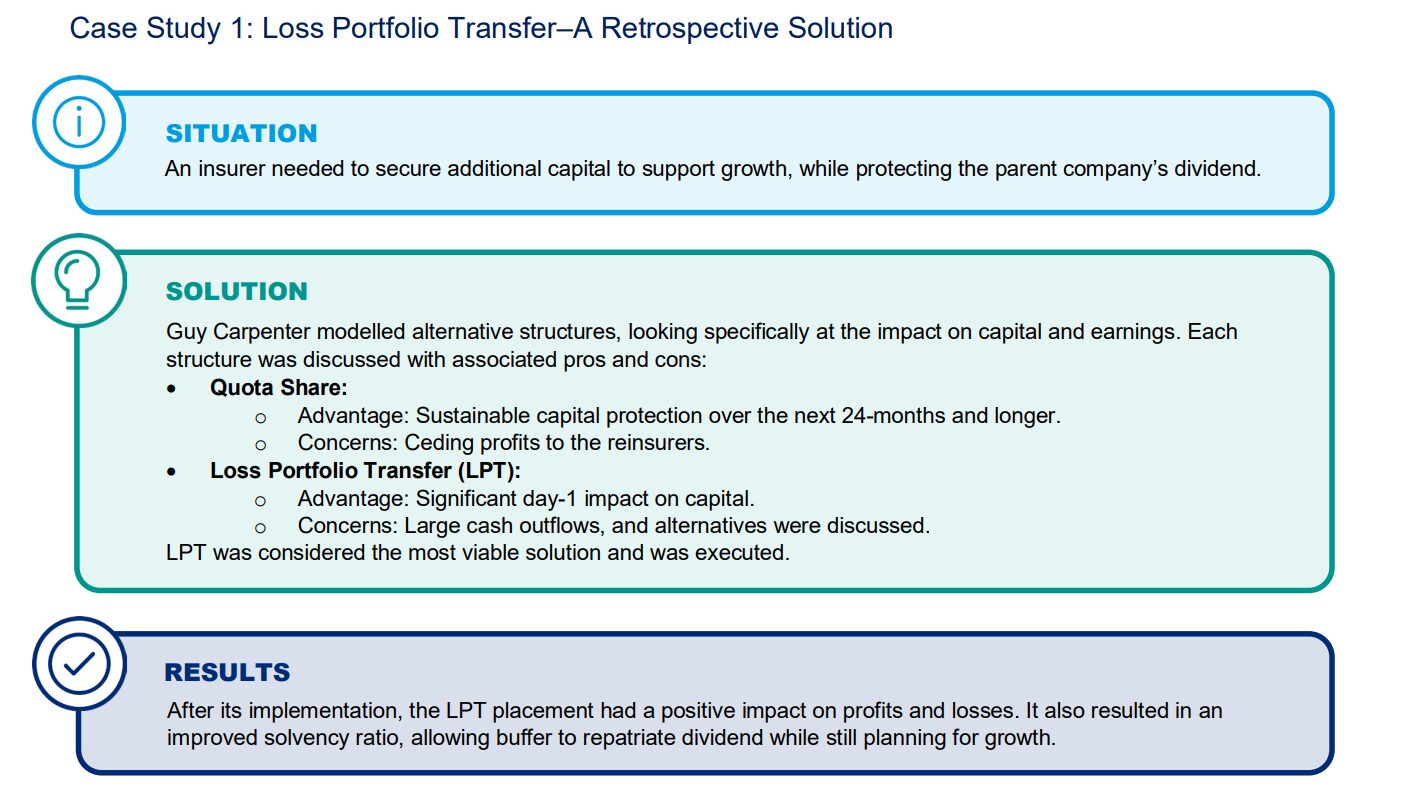

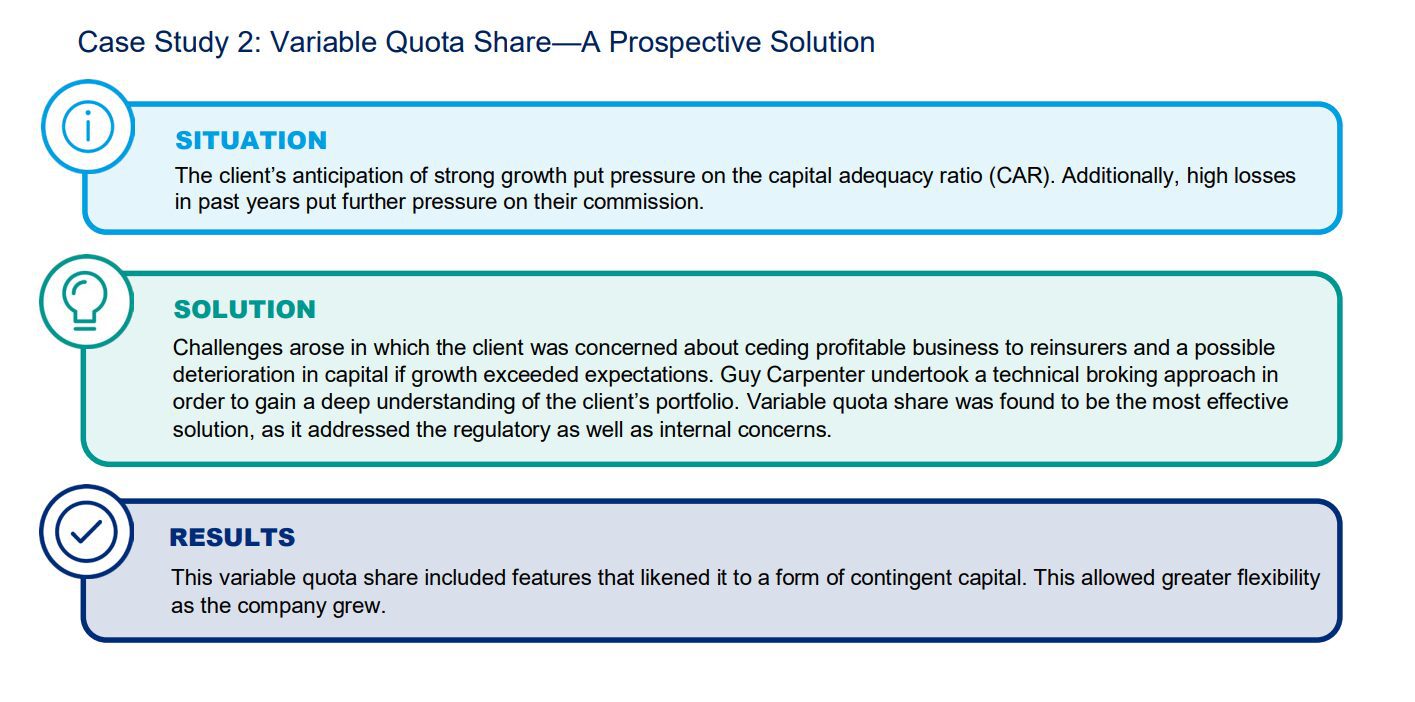

Traditionally seen primarily as a tool to manage volatility, reinsurance is key to any insurer’s capital management plan. By reducing the losses that need to be paid, it thus reduces the need for additional capital. Reinsurance recoveries are matched exactly to cash-flow needs–when losses need to be paid. Capital ratios are improved, typically without material impact on debt-to-equity ratios, thereby improving the ability to pay dividends. Reinsurance also has the added benefit of protecting insurers from capital dilution and debt covenants in comparison to Method 1. Specific coverage—whether prospective or retrospective—can be designed to meet the unique capital objectives of different insurance companies.

As the cost of debt and equity increases, insurers must maintain sufficient asset and investment capital for expected settlements.

Conclusion

With the ongoing challenges to the macroeconomic and regulatory fronts, reinsurance is an effective form of capital. Reinsurance can improve and stabilize profits, therefore helping companies achieve their capital, financial and strategic goals.

As one of the world’s leading reinsurance brokers, Guy Carpenter has the experience and expertise to help clients understand their capital needs and execute transactions that meet firms’ objectives in a time-efficient and professional manner.