Climate change is leading to increased flood risk around the world. But governments wanting to prepare their populations face a challenge in quantifying this risk, because historical data on the severity and frequency of flood risks may not be a good guide to future events. Parametric insurance, an alternative risk transfer instrument based on forward-looking models, can help beneficiaries strengthen their capacity related to floods and improve climate resilience. Parametric solutions developed for Start Network, an NGO focused on disaster relief, and African Risk Capacity, a risk pool for governments, show how such structures can work in practice, enhancing climate resilience in disaster-prone regions of the world. Looking ahead, the continuous improvement of flood risk data and parametric risk transfer mechanisms will be vital to coping with and adapting to climate change.

Strengthening climate resilience is becoming a priority for policymakers, organizations, and individuals. Floods, in particular, are a globally pervasive hazard, and are expected to become more common and more severe in the years ahead, thanks to higher levels of evaporation and expanded atmospheric water-holding capacity.

In order to prepare their populations and protect against this risk, governments need to understand and quantify it. But in a rapidly changing climate, historical data may be insufficient. This is leading many to consider parametric insurance, which is based on forward looking, probabilistic models, and pays out as soon as a given event occurs.

Defining parametric insurance and climate resilience

Parametric insurance, also known as index-based insurance, has established itself as a financial risk management tool over the past two decades. While recent years have seen considerable growth in commercial insurance, early applications were primarily found in the public and agriculture sectors. The product’s rapid payout and ability to cover remote areas were seen as crucial benefits by the policyholders, particularly in emerging markets.

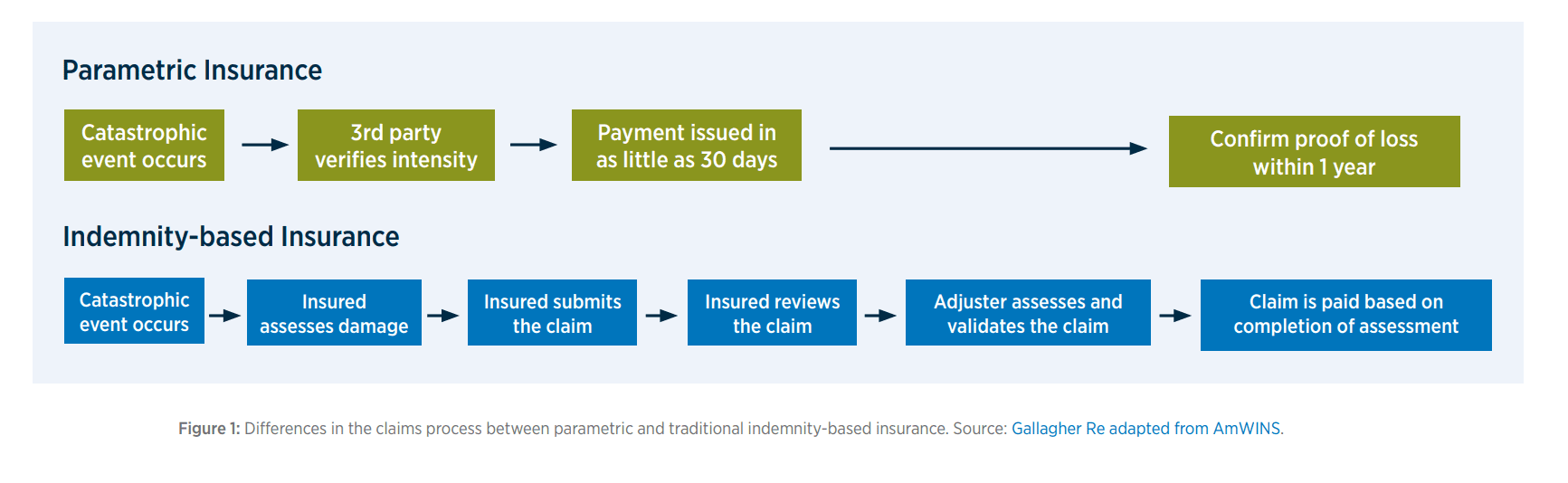

But it would be wrong to tie parametric insurance to a specific risk category or client base. Instead, it is an alternative approach to quantifying and transferring risk. While traditional insurance aims to compensate the client for the exact loss incurred (subject to the conditions of the policy), parametric products use independent datasets to create a proxy for the anticipated losses stemming from a specific event.1

Such structures respond to modeled or observed events (known as triggers) such as the magnitude of an earthquake, windspeed strength, flood depth, flight delay, customer footfall, etc., with the payouts pre-agreed between the policyholder and the (re)insurer. This considerably simplifies the related claims process, as illustrated in Figure 1.

The term climate resilience is frequently used interchangeably with climate change adaptation. However, for this article’s purposes, climate resilience refers to the capacity to learn, adapt, and transform in response to climate risks. This implies a holistic and multi-dimensional perspective, looking at various capacities across social, human, natural, physical, and financial spheres. In other words, resilience describes the individual, organizational, or societal ability to anticipate and cope with shocks and recover from their impacts.2

Climate change adaptation, on the other hand, is the process of adjusting to the adverse effects of climate variability and change. It can be categorized as a sub-component of resilience.3

Adaptation measures are often specific actions to address a certain risk. For example, introducing large-scale flood barriers in response to increased flood frequency and severity is a typical climate adaptation measure.

This in turn feeds into the wider concept of climate (flood) resilience, which also encompasses a range of actions to enhance preparation, response, and recovery capacities related to flood events.

While this article focuses on flooding, many of the principles apply to other hazards as well. Writing an insurance policy requires an understanding of the risk that is being taken on. This applies whether the policy is being provided to help an individual householder repair flood damage or support a sovereign country recover from major flooding. From the policyholder’s perspective, effective financial protection pays out quickly for all damage occurrences beyond their means to cover.

This article was written by Gallagher Re in association with JBA Risk Management.

The article is reproduced with the kind permission of ICMIF Supporting Member Gallagher Re. For more information click here.

Contributing authors: Gian Semadeni, Global Parametric & Index Insurance Solutions Lead, Gallagher Re; Paul Maisey, Technical Director, JBA Risk Management.

Published March 2024

How insurance strengthens climate resilience

Improved risk data and analysis

For insurers, setting the cost of an individual policy and managing a whole portfolio of policies both require good risk data. Knowledge of the frequency, intensity, and magnitude of all plausible flood events over a period of time is critical.

This hazard information then needs to be interpreted in terms of expected impacts (e.g., houses damaged, people affected) for the risk and the consequent insurance payments to be assessed.

This requirement for risk quantification has driven significant research into the measurement, modeling, and analysis of flood risk in recent decades within academia and the public and private sectors. The exacting data requirements of insurance mean that it has played an important role in this development.

Such measurement detail is crucial for parametric insurance, where payouts rely on the exceedance of a hazard or impact trigger designed to represent real-life conditions as closely as possible.

Flood risk data developed for the insurance industry also has applications more broadly for climate resilience. Knowing the likelihood of a flood of a specific intensity can help governments and humanitarian agencies plan and carry out actions in anticipation of major events. This includes evacuating people from areas at risk or pre-positioning food and equipment in safe locations close to where they will be needed.

Risk data taken at a regional level has the potential to identify areas of greater exposure that are also at the highest risk from flooding, facilitating an assessment of the costs and benefits of implementing structural and nature-based flood mitigation solutions. Detailed studies would then support the implementation of each individual scheme.

By using good-quality risk data and analytics, authorities can make informed decisions that increase climate resilience through behavioral change or physical intervention. These actions offer the potential for a virtuous feedback loop in which impacts are reduced, lessening the need to fall back on insurance claims.

Smoothing out financial shocks and strengthening investment security

In essence, the purpose of insurance is its ability to help manage unexpected financial shocks. No matter the risk in question, be it health, motor, or property, the ability to transfer risk provides a policyholder with protection against large losses. Almost always, the objective is to address risks that are infrequent or unlikely but that are financially devastating when they occur.

Climate risks, such as floods, have the potential to cause widespread devastation and large losses. For example, the 2022 floods in Pakistan are estimated to have caused more than USD30 billion in damages and losses, reducing the country’s GDP by approximately 2.2%.4

The financial impacts of this event were felt across individuals, companies, and the government. This is where the concept of parametric insurance can help.

Imagine a family had been able to take out a parametric flood insurance prior to the event: the rapid payout received from the policy would ensure that the family could benefit from increased financial firepower following the flood event. Since climate change has most likely exacerbated the flooding, the parametric insurance policy has also directly strengthened their climate resilience.

Additionally, insurance enables an efficient allocation of capital: instead of having to put aside major savings in anticipation of a possible major flood, excess income can be directed towards other investment or consumption activities.

A further direct contribution to climate resilience is the ability of insurance to de-risk long-term investments. Particularly in regions with considerable exposure to climate risks, lenders would be required to charge additional costs to account for the uncertainty of disaster, reducing the value of the financed asset. Whether a lender finances a new home, start-up enterprise, or industrial facility, the asset in question acts as security if the borrower defaults.

Both traditional and parametric insurance contracts can act as an additional source of collateral, allowing the lender to minimize uncertainty loadings and reduce the cost to the borrower. Therefore, insurance helps lenders and borrowers anticipate and plan for possible disaster shocks, strengthening the climate resilience of exposed assets.5

Parametric flood examples

Start Network – Pakistan

Flood risk management firm JBA has been working with Start Network, a membership group of more than 80 aid agencies across the world, to proactively manage disaster risks.

As part of its work delivering humanitarian action around the world, Start Network has developed new approaches to providing funding for humanitarian crises. One of these is Start Ready, which releases pre-agreed funding at scale, based on agreed response levels for an event. This funding enables humanitarian agencies to deliver aid in advance of crisis onset based on forecast data, with the objective of mitigating some of the worst hazard impacts on vulnerable communities.

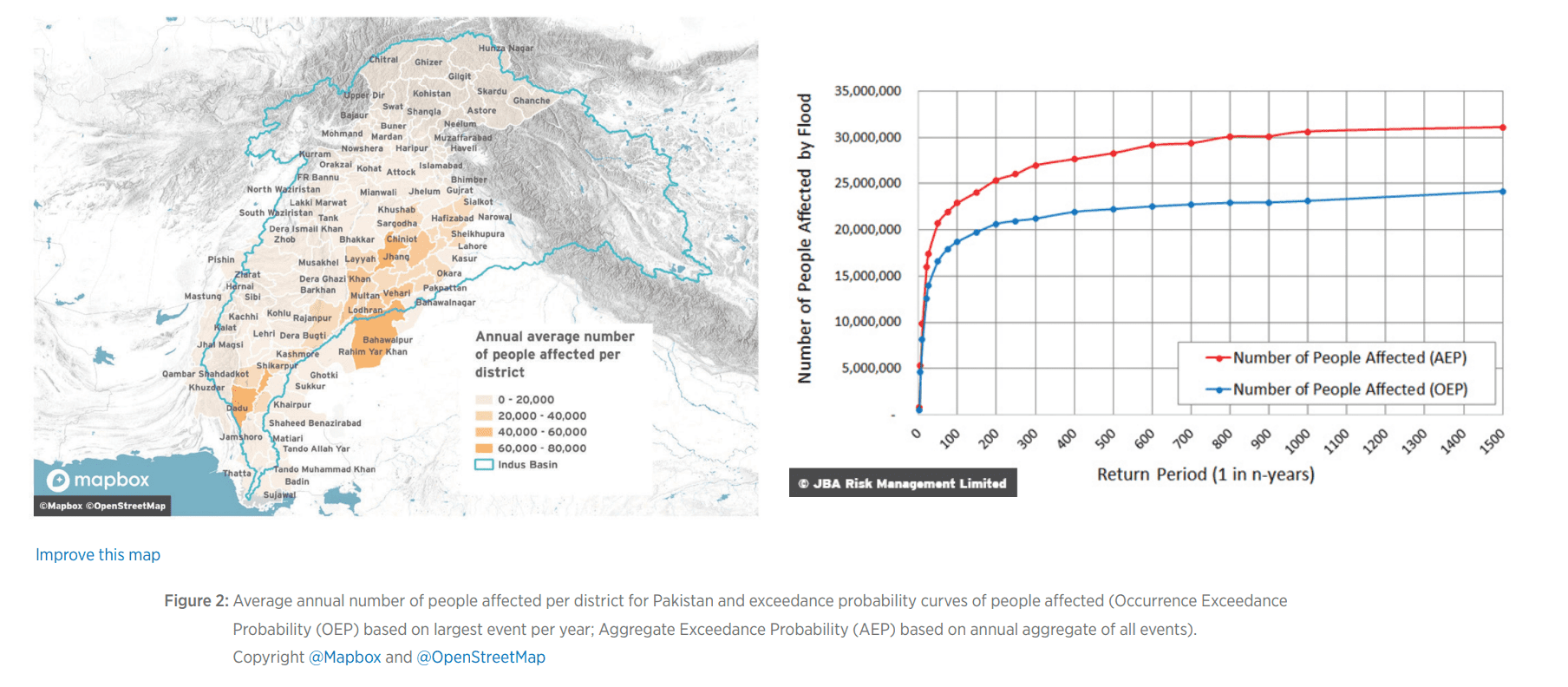

Using JBA’s flood modeling, the distribution of plausible events is being used to determine the level of risk and payout frequency, displayed as average annual impacts per district and exceedance probability curves (Figure 2).

Flood Foresight, JBA’s hydrological monitoring and forecasting system, monitors flood extent and impacts during the local rainy season in Pakistan, the Democratic Republic of the Congo, and Bangladesh. Alerts are communicated to Start Network to enable it to act when a qualifying event occurs.

African Risk Capacity (ARC)

Several partnerships between the public and private sectors are emerging with the aim of enhancing societal climate resilience through parametric mechanisms.

The African Risk Capacity (ARC) is one of the most prominent multilateral disaster risk pools, comprised of 35 African Union member states, all of which receive the opportunity to purchase risk transfer solutions aimed at addressing climate risks.

In 2014, ARC inaugurated its first drought risk pool, aimed at providing its policyholders (governments) with access to immediate liquidity to strengthen disaster relief efforts for farmers when key crops fail.

Contingency plans are also developed in tandem with governments, ensuring there is a strategy for spending the funds in the event of a disaster. Following the addition of a parametric tropical cyclone product targeted at countries in southeastern Africa, ARC has been working towards launching a flood product.

ARC has been working closely with JBA on defining the most suitable product methodology to target severe river floods impacting population centers.

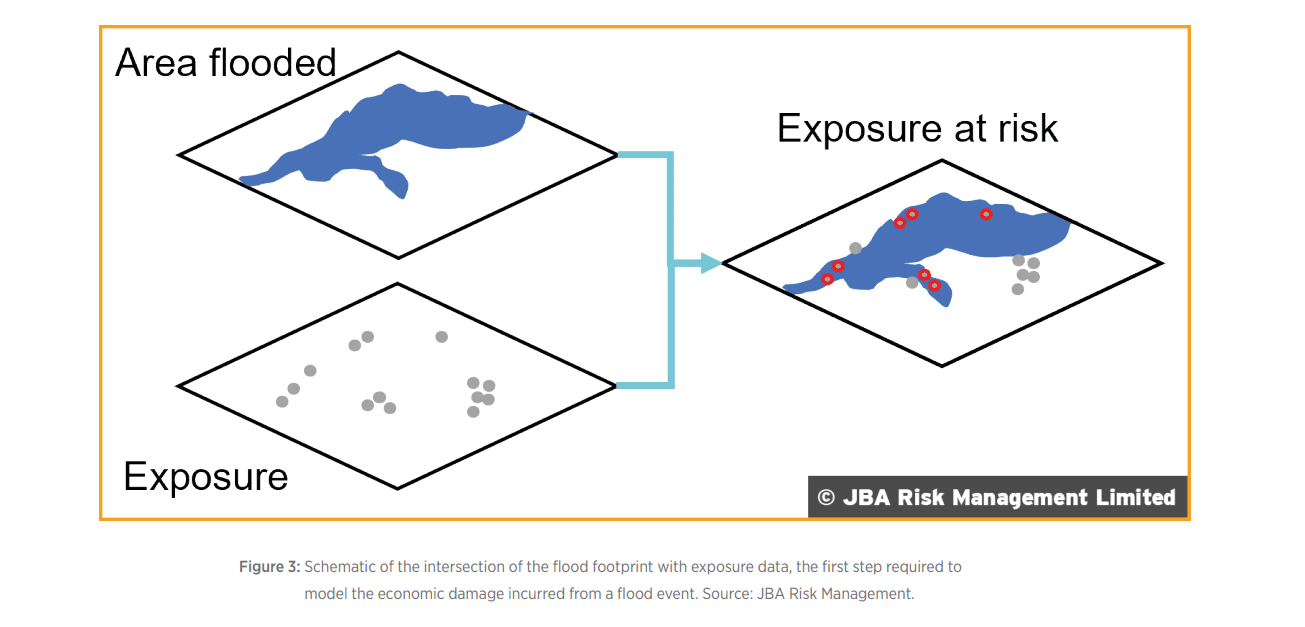

With the support of its appointed broker, Gallagher Re, ARC has been engaging with its reinsurance partners to create a parametric structure that aims to estimate the flood impact for the government in question, based on the economic damage incurred.

By utilizing JBA’s Flood Foresight system, the area flooded can be mapped and translated into estimated population impacts and direct economic damages on a societal level, as shown in Figure 3 below. The figure acts as a proxy for the emergency relief and recovery costs the government will incur, as it supports the affected population. Therefore, the government’s financial burden related to this climate risk is partially assumed by ARC and its reinsurance partners, helping to cope with the financial shock of the flood and contributing to a faster recovery.

Gallagher Re and ARC are aiming to launch the product across the first tranche of countries. Once established, the product concepts could be replicated in other member states, given the widespread prevalence of flood risk across Africa.

Outlook on the parametric and climate resilience nexus

As the examples above outline, parametric insurance has the capacity to help strengthen climate resilience on a societal level. With floods exacerbated by climate change, insurance mechanisms have an important role in managing the increasingly significant financial shocks inflicted by such events.

Compared to the traditional insurance approach of packing flood into “all-risk policies”, parametric insurance directly ties costs to the actual flood risk in the location of interest. As flood frequency and severity increase, policyholders and insurers will benefit further from risk and price transparency.

However, parametric structures are still in the development stages when it comes to scaling up, especially for highly localized risks such as floods. The variety of flood types limits the ability of a single parametric product methodology to cover surface water, coastal, and river floods at once.

The resolution of data, in space and time, needs to improve to fully represent the risk from surface water flooding caused by localized, intense rainfall. In some of the most vulnerable countries, the scarcity of data is a significant issue.

Methods for combining data from models, remote sensing instruments on satellites, and local river gauge networks can be beneficial to filling the gaps in these situations. However, as the insurance industry and its partners continue expanding into different use cases, it is important to remember that the related efforts contribute to climate resilience beyond simply providing payouts.

As previously outlined, climate resilience is also related to the increased preparedness of the population through anticipatory actions and warnings, which in turn relies on risk quantification.

For flood, this means understanding where and how often events will occur and how severe they will be, now and in the future. In turn, this requires modeling the complex interactions that link rainfall with river flow, the inundation of land by floodwater, and ultimately, the impacts on people, livelihoods, and critical infrastructure.

For the extreme events for which individuals and governments require the most protection, historical data records are insufficient to capture the full extent of potential risk. Probabilistic models bridge this gap using large sets of simulated events that retain historical data characteristics, and extend to fully capture all plausible scenarios. By adjusting for different potential future climates, such models can assess flood risk for long-term applications, despite the challenge of consistently representing flood impacts on people and assets.

Continued improvements to data quality and forward-looking modeling are expected to increase the precision of parametric products. As a proxy for actual losses, the closer parametric products are able to mirror disasters, the more confident policyholders will become in utilizing such structures and benefiting from the rapid payouts.

Insurance products based solely or primarily on historic data will become increasingly strained by the rapidly changing nature of climate risk. And in an environment where insurers might be less willing to offer “all-risk” policies, event-based products such as parametrics will play an important complementary role in targeting specific climate risks of concern with transparent pricing and claims processes.

As societies tackle growing flood risks, advancements in parametric insurance and flood modeling will expand the toolbox for increasing climate resilience and increase confidence in the ability to reduce the impacts of climate change.

1 The gap between the actual loss incurred and the insurance payout received is known as “basis risk”. A well-structured parametric product can minimize this discrepancy but not fully eliminate it. It’s important to note that traditional insurance also includes basis risk in the form of deductibles and policy conditions.

2 What is the difference between climate change adaptation and resilience?, The London School of Economics and Political Science, September 2022.

3 Strengthening Climate Resilience : Guidance for Governments and Development Co-operation, OECD iLibrary, March 2021.

4 Pakistan: Flood Damages and Economic Losses Over USD 30 billion and Reconstruction Needs Over USD 16 billion — New Assessment, The World Bank, October 2022.

5 How Insurance Drives Economic Growth, Insurance Information Institute, June 2018.