Rural insurance can support efforts towards a more balanced and inclusive development approach in emerging markets, giving rise to new risk landscapes that require a refocus of insurance on the needs and requirements of rural societies. Ensuring sustainable rural development is essential to revitalising urban communities and supporting equitable economic growth. Increasing rural insurance penetration could also form part of the insurance industry’s response to climate change as rural societies and economies are highly susceptible to climate events such as drought, floods and windstorms.

Rural economic development

Despite urbanisation accelerating around the world, 44% of the global population was estimated to reside in rural areas in 2020. In emerging markets, the ratio is typically higher– for example, rural residents accounted for 65% of the total population in India, 69% in Myanmar and 76% in Cambodia. While the level of urbanisation is appears to be strongly correlated with per capita income, recent research has outlined that it could be a non-linear relationship. Having reached a threshold, urbanisation could impede economic growth.

This could manifest in the form of urban slums, urban inequality and a phenomenon known as “poor-country urbanisation”. As a result, many countries are now steering their efforts towards a more balanced and inclusive approach to urban/rural development.

Apart from rural areas being home to a large segment of the world population, ensuring sustainable rural development is essential for the following reasons:

- Poverty is primarily a rural phenomenon. According to some studies, rural areas account for nearly 80% of the world’s poor. As a result, rural development and job creation are critical to eradicating poverty, particularly in emerging markets.

- In the aftermath of the COVID-19 pandemic, concerns over rising inequality have heightened. A recent report from Moody’s Investor Service noted that nearly half of the rated sovereigns in the Asia-Pacific region has witnessed widening inequality since 2000, particularly in China, India and Indonesia. Rural-urban disparity was a key contributor.

- Rural development is closely linked to sustainability issues like food security and biodiversity. According to the Food and Agriculture Organization of the United Nations, it is estimated that nearly one in three people in the world did not have access to adequate food in 2020, many of them residing in less developed African countries. Thus, the rural areas are where most of the malnourished can be found and part of the solution necessitates agriculture reforms.

- The development of the rural economy beyond primary production (i.e. agriculture, fishery, mining and forestry) is ushering in a period of diversification and supports the growth of higher-income households. While rural labourers are still flocking to jobs in large cities, other factor of productions (i.e. capital and technology) is increasingly being deployed in rural areas. This could happen as a result of deliberate government policies or manufacturers seeking to leverage on cheaper land and more readily available supply of labour.

The role of rural insurance

The success of rural development or rejuvenation will hinge on a mix of factors, including local natural endowment, the availability of financing and infrastructure and appropriate government policies. The support of insurance is also indispensable to the success of rural development although in somewhat in short supply, particularly in emerging markets.

The term “rural insurance” is a fuzzy concept that is not meant to define a specific product category but to focus attention on the unique needs and requirements of the rural population. The scope and potential of rural insurance has evolved in line with shifting socio-economic landscape in the rural areas. Expectedly, rural insurance is synonymous with agricultural or farm insurance as the rural economy remains heavily dependent on agriculture, forestry and fisheries in many countries. Nevertheless, rural economies are now more diversified and there is a need for different types of insurance. For example, increasing penetration of technologies has transformed the rural landscape, increased productivity of primary industries and enabled the development of manufacturing and ICT industry. Rural development has a more spatial perspective that also considers the unique features of rural areas like clean environments, attractive landscapes and cultural heritage.

This article was written by Clarence Wong, Chief Economist, Peak Re. The article is reproduced with the kind permission of ICMIF Supporting Member Peak Re.

To access the full in-depth article, including more graphics, please visit this webpage. For more insights from Peak Re’s Knowledge Centre, please click here.

The original article is provided in English only. Any translation to other languages via the ICMIF website have not been done by Peak Re, and therefore Peak Re are not liable or accountable for those translated versions.

Published March 2022

We highlight four sectors to illustrate the opportunities in rural regions: tourism, renewable energy, primary production and rural manufacturing. Developments in these four sectors are giving rise to new risk landscapes that require a re-focus of insurance on the needs and requirements of rural societies.

- While the global hospitality industry has suffered a heavy toll from the COVID-19 pandemic, it was a strong growth industry in the pre-pandemic era. Tourism historically favours rural areas with beautiful landscapes and there has recently been a renewed interest in cultural and rural tourism. The United Nations World Tourism Organization designated 2020 as the Year of Tourism and Rural Development. It sees “tourism [having] a unique ability to support the revitalization of rural communities both in the short-term as they recover from the impact of COVID-19, and promoting sustainable and inclusive growth in the long-term”.

- Rising demand for renewable energy is drawing attention to the rural sector as nearly all renewable energy technologies are space-intensive. For example, wind farms and solar generation requires a large swathe of land to accommodate infrastructure. Biofuels rely heavily on agricultural feed. Because of site requirements, the carbon capture and storage industry will initially also be situated in rural areas.

- Primary production (agriculture, forestry, mining and fisheries) will remain a vital component of the rural economy. However, land use and environmental concerns have challenged the industry to increase productivity and reduce carbon footprint. In addition, the increasing use of technologies (e.g. agritech) could also result in changes in the risks facing farmers and producers.

- Manufacturing is becoming more important to rural economies over the past decade. The proliferation of technology and automation reduces the share of labour input in production thus enabling the relocation of more manufacturing to rural areas. This is further reinforced in some markets by supportive government policies.

The development of insurance used to have a strong focus on metropolitan cities resulting in lower insurance penetration in rural than urban areas. In China, the world’s biggest emerging market, 39% of its population lives in rural areas but they only account for 18% of P&C and 9% of L&H premiums (according to Swiss Re). As societies and policymakers target inclusive and equitable growth, there is a rising expectation that insurance should increase efforts to penetrate rural regions.

The debut and increasing sophistication of inclusive insurance is helping broaden the reach of insurance to remote and underdeveloped rural areas (see Peak Re’s article on Inclusive insurance to fuel an inclusive recovery). The proliferation of new technologies makes rural insurance more viable. It helps solve some of the issues coming in the way of insurance adoption in rural areas including remoteness, dispersion of assets, costly risk and loss assessment and a general lack of underwriting data. For instance, a lack of financial literacy and infrastructure (e.g. bank account) has been a key hurdle for the penetration of insurance to rural regions in the past, especially in emerging markets. However, with the rising penetration of mobile payment technology, an increasing number of rural residents are ready to partake in financial transactions.

Rural insurance is not just about inclusive insurance. The rural risk and market landscape also supports conventional personal and commercial insurance. Nor is rural insurance only tailored for low-income households. Economic development has seen a rise in higher-income households in many rural societies.

Some markets have rules supporting rural insurance. Is India, for example, insurers must have a certain percentage of business to support rural sectors. The regulator IRDAI requires a minimum of 2% of total gross premiums to be derived from rural sectors in the first financial year of a general insurer rising to 5% in the third year and 7% in the ninth and subsequent years. Standalone health insurers should adhere to 50% of the obligations prescribed for general insurers. The requirement starts with 7% in the first financial year and rises to 16% in the fifth year and 20% in the tenth year. Recently, the IRDAI issued a discussion paper on increasing general insurance penetration in rural areas with a special focus on agriculture and allied activities through the concept of a Model Insured Village. The proposal aims to demonstrate the concept and efficacy of insurance as risk management tool and to make farmers and rural population aware of the benefits of insurance.

Instead of prescribing minimum business requirements, other markets can offer incentives to develop rural insurance, particularly for agricultural insurance. Subsidies is commonly used in both developed and emerging markets.

Conclusion

The distinction between rural and urban insurance is valid only insofar as it highlights the unique nature of insurance demand in rural areas. In fact, most insurance, like motor, health and travel, are agnostic to the rural-urban divide. With increasing attention on rural economic development and its risk management needs, demand for insurance is expected to increase supporting new agriculture production, renewable energy generation, rural manufacturing and eco-tourism. Increasing recognition of the value of natural assets also calls for better insurance protection (e.g. insuring the coral reefs).

The rural sector, which accounts for 85% of the global landmass, is the custodian of most of the world’s resources. Ensuring sustainable rural development is essential to revitalising urban communities and supporting equitable economic growth. Increasing rural insurance penetration could also form part of the insurance industry’s response to climate change as rural societies and economies are highly susceptible to climate events such as drought, floods and windstorms.

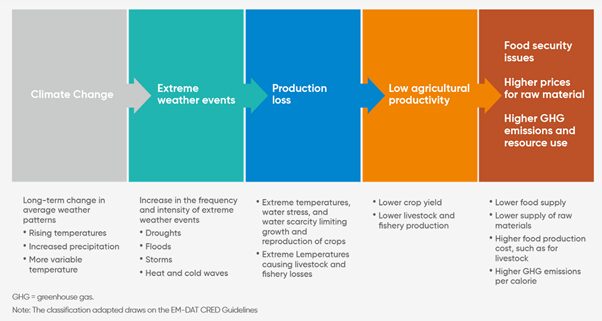

Agriculture, in particular, is vulnerable to climate change and extreme weather (see below). Rural insurance to support climate adaptation, ex-ante risk financing and innovative risk transfer can help societies better meet the challenge of climate change.

Impact of climate change on agriculture and food security