Steve Leicester:

Hi, everyone. I hope you’re all safe and well. My name is Steve Leicester, and I’m the CFO at ICMIF. I’m delighted to welcome you all to today’s ICMIF webinar, “Disclosing your climate risks: being prepared to report against the TCFD framework”.

I’m delighted to introduce three real expert speakers in this field. From Aviva, a company that’s a founding member of the TCFD, right from the start in 2015, Steve Waygood. Steve is Chief Responsible Investment Officer of Aviva Investors. Steve’s team managed £350 billion of assets under managemen; and Ben Carr, Ben is Analytics and Modelling Director at Aviva. And from The Co-operators in Canada, I’m very pleased to introduce, one of our absolute leading members in this field, Karen Higgins. Karen is the Executive Vice President and CFO. Thanks for joining us from Canada, Karen. I think it’s 5am, so an early start for you. Without further ado, I’ll hand you over to Steve Waygood. Welcome Steve, and thank you for joining us today.

Steve Waygood:

Thank you very much, indeed, Steve. It’s a huge pleasure to be able to speak with your members, and thank you very much, indeed, to your institution for the invitation to Aviva to speak with you, and I’m very much looking forward to what my colleague Ben Carr and Karen also have to share with us. Now, what I’d like to just do, in terms of setting the scene, just to canter through the agenda here. What we wanted to do, Ben and I, and with Karen’s input too, take you through a bit of the history of the TCFD and why it’s important to us all. Then go to talk about how to create a TCFD report and give our own practical advice.

Ben led the creation of Aviva’s TCFD report and he’s now… We’ve just published the fourth report, and Ben and I have worked for many years together in this space and he’s led the production of the report. He’s got a lot of practical guidance that I hope that we leave you all with. And then we’ll hand to Karen Higgins, who’ll take you through the case study on The Co-operators from Canada. Karen, thank you for joining so early. And then with the Q&A, we’ll hand back to Steve. And then as Steve says, I’ll say a few words at the end.

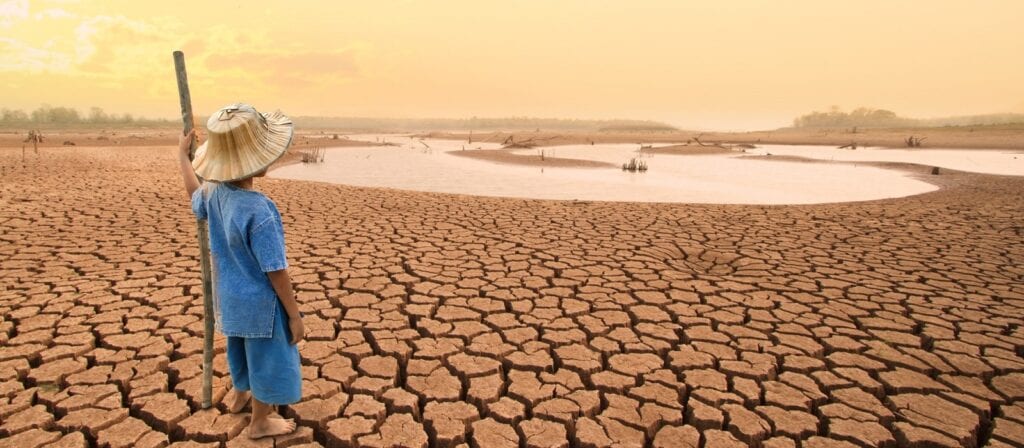

What I wanted to just do, if we step back for a second, climate change is a risk our industry has been concerned about for decades. 1994 was the first recorded debate at the Aviva board, and focusing in on what would climate risk mean to us as an industry. For many, many years, for well over a decade now, we’ve been among those insurers saying that it’s an existential crisis, potentially, for our sector. Of course, we underwrite floods, fire, and to some extent famine, and climate change will hit all of those issues.

Now, obviously, as Steve mentioned in the introduction, we as a global economy are going through an enormous challenge at the moment. Arguably, the coronavirus is the world’s biggest contemporary, medium-term environmental, social and corporate governance issue. It was an environmental problem, jumped the species boundary into humans to make a social crisis precipitate and then presented governance challenges to countries and companies alike.

So there are some similarities with climate change, but there are also some important differences. At some point, there will be a vaccine. At some point, we will have effective treatments for the coronavirus. With climate change, it is sad, science tells us we only have around 10 years, effectively, to vaccinate the global economy from the coming climate crisis.

One of the, perhaps, most important facts that we worked on over the last 10 years or so, it was a study that we did with the Economist Intelligence Unit that we commissioned back in… I think it was 2013 and then published in 2015, six months before the Paris Agreement was created. That study they say, cost nearly half a million pounds to do, and found that different scenarios had hugely profound physical risk and transition risk consequences for the global economy.

The worst scenario is when one used government discount rates, modelled out to 2100 and looked at the physical risk scenario of six degrees, which is unlikely, extremely unlikely, but plausible. At that level, 43 trillion would be wiped off the global stock of capital, that’s $43 trillion, and that was the present value in 2015 of the future hit in 2100. Clearly, that’s a discounted value, discounted 85 times, which actually, if you recount it back to 2100, the hit is in excess of 200 trillion.

Back in 2012, worried about these issues, we started to engage with the Bank of England. We were expressing then, significant concern, saying that we felt that the climate change issue presented such an important crisis that they needed to look at it in the same way they did financial stability. They needed to look at the physical and the transition risk issues associated with climate change.

I’m very pleased to say that, it took a few years and it took a transition of Governors, from Governor Kean to Governor Carney, but subsequently in 2015, Governor Carney announced in Paris in COP 21, as it’s called, The Conference of Parties of the UN Framework Convention on Climate Change. He announced that the Financial Stability Board would be taking forwards the Task Force and Climate-related Financial Disclosure. And he then cited both the EIU study, the economic study that I mentioned, as well as the significant physical risks, as you can see captured on this side, macroeconomic shocks, around what could happen as the coming climate crisis takes shape.

But also the transition risk and actually that one is nearer term. He’s referred to it more recently as a potential climate Minsky moment. That’s a rapid readjustment of prices, when the market realizes that some of the fossil fuel valuations actually don’t go out in as positive an environment for as long as the evaluation models suggest. So that transition risk is nearer term, but I personally believe it’s the physical risk that represents the even greater potential crisis. And as Governor Carney has said, the greatest risk, actually, is the risk of inaction and doing nothing.

Now, it was a wonderful moment to see the G20 work with the various central banks within the Financial Stability Board and create this institution. It’s voluntary, and in addition to being voluntary, it was industry-led. And as you can see here, geographically diverse, so 17 experts from the financial sector were joined by seven from the non-financial sector, auto sector, chemical, that kind of… Real economy businesses, and then eight other experts from around the world.

In fact, we just had a third meeting this year, it was closed yesterday evening and we now have over 1200 institutions representing over 120 trillion in assets under management endorsing this approach. We’re beginning to get governments also endorse it in their own framework.

When developing these recommendations, it was important to consider the challenges of the preparers, the issuers of debt and equity, as well as look at the opportunities of the climate changing to what would the business opportunities look like. Its contemporary focus remains a focus on the financial impacts of climate-related risks and opportunities. So rather than, what is this institution’s impact on climate change, it’s much greater focus is, how does climate change the risks associated with this business? And the expectation, is that the accounting framework within the business will accommodate the risks in various ways.

We tried to look at the opportunities as well. Around resource efficiency, what products could be brought to market, new market access, resilience of the business. And then of course, the risks are easier to conceive of, they don’t just come from the policy and legal environment shifting, it also comes from technology. And as you can see in the auto sector, the technology around electric vehicles has really disrupted that sector in perhaps the biggest way for a century.

We’ve also seen the reputational issues come to the fore. We, as a business itself have been challenged for some of the holdings that we’ve had. In fact, the last five AGMS, we’ve had campaigners turn up to challenge us on what we’re doing on climate change. It’s no coincidence that we’ve now done four TCFD reports, and actually our first climate change strategy goes back to 2012. In fact, the first time we put climate change in our voting policy was back in 2001, where we would vote against the company’s reporting accounts, if we didn’t get the material information we needed on climate change. So as you can imagine, this was a big moment for us, getting this guidance out.

As you can see the income statement, the cash flow statement, and the balance sheet, are all supposed to reflect on the risks and the opportunities. The guidance that we’ve seen come through captures this Venn diagram, the four circles within the Venn diagram. The guidance talks about, how does the institution govern the risks? What’s its business strategy? How has the strategy been updated to accommodate these risks and opportunities, then of course, embedding it in the risk management process. In fact, there’s a new document we were talking about yesterday that looks at, how do you map the Kozo risk management framework onto a climate change framework. And then of course, metrics and targets. Those metrics and targets aren’t just looking back, they’re also attempting to look forwards with scenario plans and building various different scenarios associated with how the climate is changing.

You’ll find a lot more information online, and every sector, the four approaches, those four circles within the Venn diagram apply, whether it’s governance and how does the board oversee these risks, whether it’s strategy and how is resilience integrated, whether it’s risk management or whether it’s these metrics and targets, every sector has to adopt this.

What I’m going to do now is hand over to Ben Carr, my colleague, who’s the Analytics and Modelling Director at Aviva, with huge thanks to Ben for his leadership of the creation of the TCFD reports by Aviva itself. Now, Ben, I know that you’ve been looking a lot at the way that climate change works. I will hand over to you now. You can take it forward and share with the listeners how have, we as Aviva, built our own TCFD reports, and to what extent are the regulators now encouraging us to do this and to what extent is it just voluntary. Ben, over to you.

Ben Carr:

Thanks very much, Steve. Hi to everybody and thanks very much for the opportunity to present today. I want to talk to you a little bit about, what we’ve done from a Aviva perspective and in terms of our TCFD reporting. But as Steve says, it’s not just really our commitment now to report under the TCFD recommendations on our climate-related risks and opportunities, but we now have increasing regulatory expectations in this space as well.

Our main regulator is the Bank of England. And they’ve issued a supervisory statement setting out their expectations about how climate-related risks should be integrated in a firm’s governance, strategy, risk management and reporting processes. That is something that’s driving a lot of the work that we’re doing, as well as, purely reporting under the TCFD. There’s strong alignment with what the Bank of England are asking for and what the TCFD is asking for, which is obviously really helpful.

We’re also seeing other regulatory initiatives. We’ve seen UK government, Green Finance Strategy, which was recommending TCFD recommendations be made more mandatory and that listed companies disclose on those lines. And there’s now actually output from the financial conduct authority, which is essentially proposing that climate-related disclosures will basically become mandatory from 2022. This is an area where we’re increasingly required to do something not just an area where we’re choosing to do same.

What we’ve done in order to address these requirements is that we’ve updated our senior management functions statement of responsibility. We’ve now made it clear that, chief risk officers are responsible for managing climate-related risks at Aviva, and that we’ve put a plan in place effectively to support our chief risk officers to build that out and meet those responsibilities.

What have we done to do that? In order to support the CROs, we’ve built a sort of interdisciplinary team internally. I work in the group risk and the actuary area. So we’ve got people working in that area to think about how we go about integrating climate-related risks, and developing metrics and modeling those risks going forward. But we’ve also got people from investment side, and in particular, from Steve’s area where we’ve got significant expertise on responsible investment, making sure we’re bringing that into play. And then in addition, we’re working with our business units throughout the world. We’ve got businesses in the UK, both general insurance and life insurance, but also businesses in France and other European countries, as well as in Canada. We need to bring expertise from both a geographical and functional perspective to start to build out and to build and integrate these risks and report on these risks going forward.

It’s not an area where one person or one group within the firm has all the information or knowledge that’s required. It’s so broad ranging in terms of its potential impacts on the insurance business that you really need to build out that capability and to make sure you’re building those interdisciplinary teams to support the work.

We’ve also brought in external expertise, we set up an expert panel. In particular, we’ve got London School of Economics providing us with external support to compliment the expertise we already have internally, from an insurance perspective, with genuine climate scientists and science expertise from the academic world. We found that very, very valuable and important in building out our capability.

In order to start to embed what we’re doing, it’s not just about producing a disclosure, we’ve updated our risk policies, we’ve updated instructions for business planning. People are taking account of climate-related risks in the way they’re managing the business, and in governance and strategy going forward. And we’re also working collaboratively, externally with United Nations Environment Program and with other industry associations and sector peers. Make sure we understand what good looks like, in order to recognizing that what we really need is comparable and consistent approaches across the page, if we’re going to really make both TCFD disclosures effective, both from an investor and an investee perspective. But also to ensure that we’re working together and building out this capability in a collaborative way across the page. We don’t necessarily see this as a competitive issue, in many cases, it is an area where we can work together. And we think that, in particular, private and public policy is very important from a regulatory, for example, perspective.

We’ve also recently joined the Net-Zero Asset Owners Alliance, which is an important initiative where we’re committing to be net-zero from an investment… Net-zero investor by 2050, in line with the Paris Agreement. That’s how we’ve gone about building capability and that’s the thing that’s really helped us to publish our last four climate-related financial disclosures and to build out on some of the analysis that we can do. And in particular, it’s helped us to build out some scenario analysis capability which people consider to be one of the most challenging aspects of TCFD disclosure.

Just skipped on one extra line there. In terms of the structure, our TCFD reports, we effectively have three elements to it. We have a two page item in our strategic report. That’s in the reports and accounts that summarizes what we’ve been doing on climate-related financial disclosure. And then what we do is we have a longer disclosure that we publish alongside our report and accounts on the same day, which provides much more detail on what we’ve done on governance, strategy, risk management, metrics and targets. Then finally, we’re also producing a dashboard that sets out the key metrics that we’ve used for our climate-related disclosure in a nice full page format that helps people to get to the key information rapidly. We found that split approach has worked pretty well, and we find that we’ve had good feedback from our shareholders and investors on that approach. You can find all of this sets on our website, this is all publicly available.

What have we learned? I guess, the key question. I guess, one of the things in the TCFD that is recommended for asset owners is that you publish carbon intensity information. That’s essentially, you look at tons of CO2 per million dollars of revenue, and that can give you a view on the carbon intensity of your equities or your corporate bond portfolios, for example. Now, that’s a useful measure, and it’s quite objective because there are quite good reporting requirements now around carbon emissions. It’s a relatively grounded measure. But we found it was not… Internally, if you go and tell somebody, this company has got 185 tons of CO2 per million dollars of revenue, it doesn’t really resonate. It doesn’t really… It’s very difficult for people to engage with that.

One of the measures that we’ve been publishing, we found really powerful in that context is, a portfolio warming potential. What these portfolio warming potential measures are doing, is they’re translating those carbon intensity measures into an equivalent level of warming. You can then use that to explain to people how aligned your portfolio is, your equity or corporate bond portfolio with the Paris Agreement, as well as with market benchmarks and business as usual scenarios. So i.e, the scenario the world is currently on in terms of level of warming we’d expect. What that’s telling us about Aviva is that currently, overall, Aviva’s got a portfolio warming potential on its shareholder assets of around 2.9 degrees. That’s clearly above Paris Agreement, so there’s more work to do there, the one and a half to two degree target. But it’s significantly low, the market benchmark, which is around about three and a half degrees or the business as usual scenarios of four degrees centigrade.

What this is telling us is, and communicating is that, whilst there’s still more work to do on Paris, we’re ahead of the market. We’re ahead of where the world is heading and that reflects all the work that we’re doing to try and align our business to Paris. But it also demonstrates that as a globally diversified investor, it’s very, very difficult for us to get ahead of the world. So if the world is on a particular trajectory, we may be able to move up, hopefully, a little bit, and to eke out a few points of temperature rise. But we really need to be actively engaged in governments and others, as well as engaging companies in the real economy, in order to make sure that we can drive down, both the portfolio in potential of our portfolio, but also make sure that the world is on the right trajectory.

We found that this type of measure been really, really powerful. Now, there are some challenges around this measure. These are not perfect at the moment, there’s a lot of work still to be done. And that’s one of the reasons why we think it’s very important to work with peers and regulators, and NGOs, and multinational organizations, in order to make sure that we’re building out really rigorous, and well understood, and comparable measures going forward. But certainly, this type of measure seems quite a powerful way to communicate and help to drive behaviour and action.

That’s the portfolio warming measure. Now, coming back to one of the points Steve made earlier, that is, that’s great in terms of that’s an outside in measure. It’s an inside out measure, to be honest. It’s telling us what our impact is on the climate, but it’s not telling us what’s the climate’s impact or different scenarios impact is on Aviva and the financial impact on our business.

The other thing that we’ve been developing, and we’re doing this in conjunction with the United Nations Environment Program and MSCI Carbon Delta, is develop a Climate VaR type measure, Climate Value-at-Risk measure. What this does is it tells us in different scenarios, so we’ve taken the intergovernmental panel on climate change scenarios, a one and a half to three, four degrees scenario, and we’ve used the Climate VaR to measure the impact on Aviva’s business. What we’re doing is, we recognize a lot of uncertainty in these measures at the moment, and a lot of uncertainty and some of the assumptions that are made, so what we do is, we don’t publish a… What we’re really interested in is the relative impact of these different scenarios and we’re also interested in the plausible range of outcomes, not in a point estimate of what the impact is.

What this analysis is telling us, and presented on the screen, is that we are most exposed to a… It’s not a hothouse type scenario where you get runaway global warming, the four degree scenario. And in that scenario, what we’re seeing is that physical risk dominates, and it’s negatively affecting long-term investment returns on equities, corporate bonds, real estate, real estate loans and sovereign exposures. And that’s the thing that really, really kills us.

The other thing that we’re seeing is that, the only scenarios where we see potential upside is in those scenarios where we actually meet the Paris Agreement. So, one and a half, two degree scenarios, where we can potentially, if we can realign our business, there are transition risk opportunities that we can benefit from in investing in the transition to a low carbon economy and that gives us some potential uplift in the one and a half to two degree scenarios. And the more that we invest in that low transition economy, the more we believe that we could see those scenarios as having significant upside. But it’s very difficult to see how we can mitigate the physical risk and those hothouse type scenarios.

The other thing that we’ve done is, it tells us is if we look at the mix of different scenarios and we produce an aggregate output as well. So we basically, looking at the analysis and the science, we can look at what is the likelihood of these different scenarios and we see that aggregate outcome is dominated really by the three and four degrees scenario. That really just reflects the fact that currently, we’re not on track to meet Paris, and countries and companies aren’t making the progress they need to make, if we’re going to hit the one and a half or two degree outcome.

I think finally, the other item we’ve seen is you’ve got a breakdown of the different scenarios on what the split is between physical and transition risks. Physical risk is, more extreme weather or chronic weather effects, transition risk is the effects of the transition to a low carbon economy, and potential disruption to carbon intensive sectors and the investments that we have in those. What you can see is that, in the one and a half degrees scenario, it’s sort of dominated by transition risk but there’s still some physical risk because, currently the world’s at about one degree so you’d still expect to see some physical effects of the one and a half degree level. And again, at the two degree, you’ve got a bit more balance. There’s a bit more balance between transition and physical risk, but really the three and four degrees scenarios, they’re dominated by the physical risk which reflects there’s less transition, because the world isn’t doing the things it needs to do to meet Paris but you have these big physical effects coming through.

Again, one of the things that we think we’ve learned from the analysis we’re doing is really all the models that are out there, probably attending to undercook actually the physical risk in those more extreme scenarios, because they’re not capturing tipping points and they’re also not thinking through the impact. Sometimes the discounting, because some of these physical effects are happening a long time down the track that sometimes they’re potentially dampening the effects of some of these physical risks and these more hothouse scenarios.

That’s, again, a key lesson for us is making sure you get the right balance between transition and physical risk, and how you integrate those into your modeling, as well as making sure you’ve paid proper attention to how those physical risks could really impact your business and your business model and strategy going forward is really, really important.

That’s the main points I wanted to make initially.

Steve Leicester:

I’ll just step in for a second. Thanks, that’s very interesting to see how Aviva really are taking a lead in this area. I would encourage members to view the TCFD reports that Aviva prepare.

Now, I’d like to introduce Karen Higgins, CFO of The Co-operators in Canada. Thank you again for joining us Karen. As I said earlier, The Co-operators are one of the leading companies in this area. Karen, perhaps you could take us through the journey your company has been on, and where you look to in respect to the TCFD.

Karen Higgins:

Great. Thank you very much, Steve, and absolutely thrilled to be here despite the early hour from Canada. I was absolutely just captivated by the story that Steve and Ben just took us through. I’ll let you guys know right away, there’s some very interesting stuff that I intend to take back to my team and just steal right from you because it was really, really interesting. I was particularly interested in the warming diagrams that you showed related to your investments. So thank you for that.

Let me just take you a little bit through the journey that The Co-operators have been on. I think many of you on this call are familiar with our organization. We are a Canadian co-operative, we are a multiline insure focused in both the property and casualty space, as well as the life insurance space. Our investment management subsidiary, Addenda Capital, is a leading organization, obviously, in the investment management space, but in particular, on the impact investing stage as well as significant efforts put forward by their organization with ESG, and really have become quite recognized from a global perspective.

Let me talk a little bit about our history. Canadians, our Canadian communities and our businesses, certainly bear the impacts of changing climate. A recent Canadian study has shown that Canada on average is experiencing warming at twice the rate of the rest of the world. These warming effects are causing greater volatility in what their patterns and affecting the liability of many regions across our country. We can already see the effects within the property and casualty industry, with stark increases and catastrophic losses in recent decades, fuelled primarily by the increasing risk of extreme weather and natural disasters.

As Steve noted, in 2015, the Financial Stability Board established an industry led Task force for Climate-Related Financial Disclosures or as we call it TCFD. As you know, the TCFD developed voluntary consistent climate-related financial disclosures that can be useful to lenders, insurers, and investors, to understand material risks, and building climate risk into their decision-making.

In June 2017, the TCFD released their final report, which we publicly endorsed. We felt that the report was integral to ensuring that companies could bake climate-related risks into their strategy, assessing the risks, and more importantly, sharing broadly what those risks mean to the organization. We welcomed the disclosure requirements, and we began a three year roadmap to fully adopt the TCFD recommendations, which cover the areas as Steve noted of governance, strategy, risk management, and metrics and targets. In 2018, we published our first disclosure within our management discussion and analysis within our public company Co-operators General, and that followed some preliminary disclosures that we did in our integrated report.

Why did we do that? We believe that to protect the financial security and peace of mind of Canadians in their communities, we must understand the risks and opportunities posed by climate change. We strive to be a champion and a catalyst of a sustainable climate resilient society, and are committed to integrating climate related risk into our governance models and business practices. As a long-time advocate for increased focus and action on climate change, we welcomed the FSB’s mandate to increase investor and consumer awareness over what we believe is the most pressing issue of our time.

And in 2019, we published our inaugural standalone report. Now, I have to tell the audience that we did indeed finalize our report, it was to be issued in April at our AGM, but our AGM like can sure many of you experienced was deferred. We do intend to hold our AGM in June and it’s our sincere hope that our inaugural standalone report will be released publicly at that time along with our 2019 inaugural report. What I’m sharing hasn’t been released to the public yet, but we are we’re ready to go as soon as the clock turns over to our next month. In our inaugural report, we showed what we were doing in terms of our roadmaps. 2019 is actually year two of our three year roadmap. And we have been continually progressing along with the various initiatives that we had in place.

As I stated, assessing the impact of climate change has been a significant part of our business activities. Our sustainability policy was actually created in 2008, and it formalized our consideration of environmental, social and resiliency in all areas over the long-term. Our approach to sustainability is holistic, and it’s been integrated into our products and services, our practices and how we engage with our stakeholders. We’re committed to expanding our efforts to enhance our climate risk practices and disclosures, and leading the industry among similar size cohorts.

In 2019, we formalized our commitment to a net-zero emission future by signing the Accountance For Sustainability or A4S, statement of support in conjunction with our global peers. In addition, we participate in industry wide working groups to develop tools to improve our ability to align with the recommendations of the TCFD. These recommendations are designed to lead to more effective corporate climate risk management and better informed evaluations of such risks and exposures by lenders, insurers and investors.

So our three year roadmap focused in the four key areas that Steve highlighted earlier, governance, strategy, risk management, and metrics and targets. And as I said, we’ve been continually progressing along. We’ve been very fortunate within The Co-operators to always have had a very strong governance structure, particularly as it relates to climate risk. We have a joint steering committee that is made up of senior leaders within our organization, as well as board members that work towards various aspects of climate issues, including work that we’ve been doing with respect to TCFD. But we also have a board committee that is focused on sustainability, and it’s been an important part of our journey.

In 2018, as I said, we developed our roadmap, we ensured that we had full alignment with our board committees, and we published our first climate commitment. In 2018, we completed our new four year strategy which focused on the years 2019 to 2022, and we fully integrated climate risk into our strategic planning process. We also aligned climate risk was with the 2030 UN SDGs. We also focused at a high level, our engagement of TCFD, as I said earlier within our integrated annual report and our own DNA.

If we move ahead to 2019, we fully aligned our climate governance with our new four year strategy, and we began work with the UNEP-FI initiative, which Ben spoke to earlier. That’s been a very important part of our work, particularly as we begin to think about our own scenario analysis. We started to more deeply understand, primarily from a scenario basis, how our industry is impacted from climate change, on both the P&C and life sides of our business. And as we look ahead to 2020, we intend to provide climate education to our board committees and to our board of directors, and this year is to be the year where we start to perform and quantify our two degree scenario analysis.

Now, I would say in terms of challenges, that that probably is the area where we are focused but also where we probably think that it is our biggest challenge. As I said earlier, we are a Canadian insurer, a big part of our business is on the property and casualty side, which isn’t any different than Aviva has discussed. But really quantifying the impacts to us is certainly been a challenge, and that’s where we have been fortunate to be involved within the UNEP FI initiative. My colleague Barb Turley-McIntyre, who’s the head of our sustainability practice within the organization, is a key member of that project.

I’ll speak just briefly to their TCFD initiative. It is made up, along with Aviva, of 22 global insurers and reinsurers. The project has engaged PWC as their lead consultant, and there are five case studies that are included as part of the project, and it’s been very important to us at The Co-operators to have Canada selected for a study.

When you look at the warming trends and the impacts globally, we are very fortunate to be in Canada because in many cases we have a very, very strong insurance platform. And so in some ways, believe it or not, that actually can create a bit of a negative to us being an area of focus, because we do have a backstop for many Canadians and Canadian businesses. But nevertheless, we were successful to have a flood as it impacts residential property included as one of the key studies. So we’re really, really pleased with that because from a Canadian insurer perspective, water has become one of the most significant impacts.

And then, just for information, flood is also being included from a Europe perspective, hurricanes and cyclones in the US and Japan, flood from an Australian perspective on commercial real estate, and then the impacts within Europe on energy and utilities. And so, we’re very much looking forward to that final report, which is expected to be done in November of 2020. With those comments, Ben, I think I’ll turn it back to you. That gives everyone a really quick story from The Co-operators’ perspective, and I’ll let Ben moderate the Q&A. Thanks very much.

Steve Leicester:

Thanks Karen, that was very enlightening, understanding The Co-operators’ roadmap on that TCFD journey. We’ve now got time for questions for the panel. Are there any questions, Steve, you’d like to ask Karen, before we start those?

Steve Waygood:

Thank you very much for the invitation to do so, that’s very kind of you. Karen, you’ve mentioned a lot of points that relate to Canada, specifically, you’ve talked about the challenges. There’s obviously the interrelationship in Canada as well with the local communities and the social consequences and how the broader challenge of sustainability can come through. To what extent are you saying that the political environment around the oil-shale and the benefits of oil-shale to the local people? How are you… Do you think that the political challenges that presents are causing problems or is it perceived more as an opportunity? In other words, the tar sands, as they’re also referred to, create a lot of financial benefit for people in Canada, is that affecting the debate in any way?

Karen Higgins:

Steve, that’s a loaded question for me at quarter to six in the morning. But you’re absolutely right. The climate issue from a Canadian perspective is a very hot political potato, if we want to use that term. The energy sector within Canada is a big driver of our economy and frankly, those companies that are publicly listed to form a large component of the Canadian stock exchange are based in Toronto. It is a challenging balance, but I would say from our perspective, we do view it as an opportunity. Certainly, as we think about it from an investment perspective, we are very engaged with those companies that we hold equities in, and we continue to be engaged with them as they transition from fossil fuel base to those types of mechanisms that lead to a greener economy.

It’s always a challenge for us and for other Canadian companies that invest within the Canadian equity market. If you were to pull out all of your investments in those companies, it makes it very difficult for those companies to transition from where they are to where they know that they need to be. And I think that’s the key messages, that many of these companies are already acting on a move to a greener economy and they know that that is what they need to do. And from our own investment perspective, those are the companies that we continue to be engaged in. Some of those energy companies that you would immediately think of from a Canadian perspective are absolutely transitioning and they are making investments in greener fuel sources, and in fact, had been a part of our impact investment portfolio.

When you think about it from a political perspective, it is challenging because there are those pushes and pulls. Our current federal government is very vocal about the need to transition and so we continue to be supportive of all political levels, whether it’s provincial or federal, as they focus on those kinds of things, and we remain supportive of their efforts in that regard.

Steve Waygood:

Thank you, Karen. Excellent answer. We, obviously, are investors into Canada too, and have the same approach as you, in terms of ownership, engagement, and challenging them to be part of the transition. It’s always important to balance the social economic and environmental issues all in the same breath, particularly given how important the revenues are from the oil-shale industries in that region to developments and then the poverty alleviation. Steve, back to you…

Steve Leicester:

Thank you. Can I ask you, a lot of our members that are just starting out on their TCFD disclosures, do you have any tips for them and any pitfalls they should be aware of? Maybe Karen, you could answer that?

Karen Higgins:

Absolutely. I would have three comments, and I suspect if Steve were answering this question he would have similar ones. First, it’s really important to have your senior leadership engaged in the importance of the work. Our efforts have been led jointly by myself, as one, as well as one of, one of my colleagues who supports a number of our corporate functions, including our sustainability function. That’s the key thing. It’s that message and tone from the top that’s vital to driving this work forward.

The second piece is to ensure that your board is aligned, because if your board supports what management is doing, you’ll always be further ahead. And as I talked about earlier, our board has been very supportive of all of our sustainability efforts, and as we drive it further into the work on TCFD remains equally supportive. In fact, on an annual basis, we have a joint meeting between our sustainability committee and our risk committee, so they really have a great opportunity to align those two governance functions, and then the largest focus of that meeting is our work on TCFD and how we continue to drive this forward.

The third piece that is so vital, and it’s exactly what Ben talked about earlier, and that was creating the working group that is really cross-functional and cross-expertise. Our working group is made up of finance leaders, actuarial leaders, sustainability leaders, communications, strategy, and governance, as well as supported by our investment team. It’s a really wide range of expertise, but exactly what you need to really ensure that you’re thinking about all the various aspects of climate, and how it will impact the various risks and opportunities that we face.

Steve Leicester:

Thanks, Karen. Have you faced any problems in terms of quantifying some of the disclosures into financial terms? I’m thinking that some of the disclosures, in respect of maybe scenario analysis is quite judgmental. Maybe, is that a question for, Ben?

Ben Carr:

Yeah, sure. There was certainly lots of discussion around the metrics that we’ve disclosed to date in our TCFD reports. In our dashboard and in our disclosure, we disclose information on carbon intensity for equities and corporate bonds, we disclose our portfolio warming, we disclose say the relative outcomes of the scenario analysis that we’re doing for the Climate VaR and we also disclose some information around the sovereign exposures and our weather related losses. And I think that we… As part of the process of getting people comfortable with the disclosure, we went to virtually, every committee, I think internally. We went to ALCO, and we went to board risk committees, and we went to overall board, we went through the whole governance process and made sure that everybody was really comfortable and understood the metrics we were disclosing, what the messages around those were. By doing that, I think we gave people confidence that we’re happy to disclose the metrics we are disclosing. I think that’s been successful but it’s definitely a real challenge.

Certainly, things like the portfolio warming, initially, it took a while to get everybody on board with going out with a figure like that. And it’s partly around, some of the uncertainty at the moment around how those measures are being produced. You’re operating in an evolving and maturing space, so I think there needs to be a bit of an acceptance that some of the measures at the moment are not perfect and they will need to be refined over time. And therefore, you need to message that externally as well as internally.

But it’s also just because they’re new measures, it’s how is the market going to react to those measures. Again, thinking about how you position those portfolio warming measures, for example, was a really important part of the discussion and debate that we had internally. But I think the more you can expose and get people familiar and people understand that the limitations, as well as the strength of the message you’ve got, and you’re having that discussion at all levels of the organization, then you can get people bought in and you can dispose the right level of information.

Steve Leicester:

Okay. Thank you. Finally, Steve, do you see the TCFD recommendations become mandatory, and this other case we’re putting pressure on the highest carbon emitting countries be made mandatory first?

Steve Waygood:

Brilliant question. Yes, I do. In fact, I only took the position on the TCFD itself back in 2015 on the basis that, we had been arguing, for not voluntary measures, which is what the TCFD is, but we’d been arguing for mandatory measures. So I said, “As long as you don’t expect me to change that position, I’m happy to join the group,” and they agreed. I’m very pleased to say that the UK government has indicated that it will become mandatory, both for pension schemes, as well as for large listed businesses, both of those are going through a consultation.

As we speak, also the Green New Deal under Ursula von der Leyen, the President of the Commission, she has made it very clear that that Green New Deal will have all sorts of climate disclosures, and the commission has also made it clear that they think TCFD is state of the art and also where they expect to be heading. There’s something called the Non-Financial Reporting Directive within Europe and they’re just consulting on that, and it’s broadly expected that the conclusion of that will be that it’s mandatory.

Now, that doesn’t mean the whole G20 has made it globally mandatory and binding. But we’re beginning to see some stock markets change listing rules, the UK actually did it in 2012, following actually a challenge that we raised in 2011, I’m pleased that we did that. But we’re also seeing other investors adopt an approach to voting where they’ll vote against the report and accounts, if it doesn’t include material climate change data. That stewardship piece, the kind of non-voluntary, if you like, but non-binding area where investors play an ownership role for those businesses that are listed, they will find themselves under ever great depression from the from the outside on this.

Steve Leicester:

Excellent. Of course we are passed way out of time. So Steve, can I turn to you for your closing remarks, please?

Steve Waygood:

Thank you. I think it’s just… We started at the beginning, didn’t we, by talking about just how big a challenge climate change will be and how, even looking at what’s happened with the coronavirus and the huge social consequences and financial and economic challenges that that’s presented, it still pales in comparison to the potential impacts of climate change. I think it’s worth just pausing at this point to say, whilst disclosure, and reporting, and measurement, and management, are also important, it’s not by any means the end game. The end game needs to be, making sure that every organ of society, every financial institution factors climate risk in, and does its bit to allocate capital to deal with this challenge. We would expect, for example the FSB, to not just talk about disclosure, but start to change the prudential framework, whether it’s for banks or insurance companies, to reflect climate risk and ensure that they’re not exacerbating the problem with the way that prudential framework is currently structured.

We’d expect a global debate about fiduciary duty and what it means to be an investor, and to be aware of climate risk, and how you behave as an owner, in the way that Karen was describing that they’ve been doing in the oil-shale holdings. That they’ve got challenging companies to encourage them to be part of a climate friendly future and to embark on that transition to net-zero by 2050, at the latest. We need to rewrite listing rules, accounting standards, governance codes, stewardship codes.

This is just the beginning, and we need to work out how we get public lead tables, ranking companies on their performance in this area to the end investors, so that we create a much greater financial literacy and climate literacy in the conversation around capitalism than we currently have at the moment. Tell you, most people have no idea how their pensions and insurance work, let alone what the implications are for climate change. That needs to change.

Even that though, won’t be enough. We need to make sure that it costs companies to mess Paris. We need to make sure that it actually pays them to align with the Paris Agreement and deliver it. We also need to make sure that investors time horizons start to factor in these very long-term risks. At the moment, the vast majority of even fundamental analysts, will only model three to five years before they then revert to a mean growth rate. That’s a tacky point, but nevertheless, I think valuation assumptions need to be challenged.

It’s time, I think, to harness the capital markets to deliver a more climate friendly future. And we, obviously, in the UK will be hosting COP 26 next year, which is the Conference of Parties, after COP 21 that created the Paris Agreement and finance will be in focus. And we’re hoping, that the UK government and the presidency of COP will create something called an International Panel on Climate Finance, which will talk about how you mobilize money. How do we harness the $370 trillion in the global capital markets to finance the future that our customers wish to see?

And that at the moment is a piece of the global governance system that’s missing. We need to bring the IMF, the UN, the World Bank together with the biggest asset owners from pension schemes, banks, and insurance companies, so that we actually mobilize capital and harness the power of capitalism to deliver the future we need. I just wanted to say those few words, Steve, to make sure that none of us felt that the TCFD was enough. It isn’t. It’s a step in the right direction, but it is only a thermometer. It doesn’t turn the heat down in the system, at all. Back to you.

Steve Leicester:

Okay. Thank you. I have to say that was really, very inspiring. That just leaves me time to thank our panel again on a fascinating topic. We really appreciate your time and insights. Thank you everybody for listening and I hoped you enjoyed it. Until the next time, goodbye and stay safe.

The above text has been produced by machine transcription from the webinar recording. ICMIF has made every effort to ensure that transcriptions are as accurate as possible, however, in some cases some text may be incomplete or inaccurate due to inaudible passages or transcription errors. Listening to or watching the webinar recording will allow you to hear the full text as delivered during the webinar but this is available in English only. Our transcriptions are provided to enable members to select the language of their choosing using the dropdown menu above.