The legalisation of cannabis is a big opportunity for insurers and is forecast to become a USD 27 billion global industry by 2021. To enter this legalised market, farmers, harvesters and retailers all need some form of specialist insurance. However, as with any emerging risk/market, there are many unknowns at this early stage; so for insurers this is, in many ways, unchartered legal and regulatory territory.

As an early adopter of the legalisation, Canada has handled the rollout in a responsible way in an effort to avoid abuse, but there are increased risks due to numerous unknowns. Strict licencing covers the mass growing of the drug, but up to four plants per household are also allowed to be grown for private consumption. This is difficult to monitor. Under the new controlled access laws in Canada, anyone over the age of 18 can possess up to 30g of cannabis and can purchase professionally dried or oil derivative cannabis from an approved retailer. Enforcement of the new laws comes via the Federal Government, although Provinces have the power to reduce the approved amounts and how it is sold.

Industrial hemp growing needs a lot of specialist equipment and high levels of humidity and therefore good ventilation. There are risks of erosion in the structure of the buildings where the growing takes place and these risks require further assessment in order to fully understand what best practice mitigation looks like.

The USA will be watching Canada closely in terms of their approach to rolling out risk mitigation and laws. Canada has ensured pricing and taxation are carefully monitored to keep the retail price below criminal pricing. There are currently 25 insurance carriers in the USA which are insuring cannabis-related risk. However, there is still a stigma related to this sort of business which therefore means that it is only placed by certain specialist brokers which is very expensive. There remain some concerns, and therefore public debate, about age restrictions and whether this is a ‘gateway drug’. There are very defined demographic splits in terms of attitude and tolerance to these new laws.

The cannabis market includes edibles, liquids, resin, vapours and dried smoked leaves. Edibles are particularly difficult to control as there is a dosage per bite and the effect on the user can take anything between one and six hours to be felt. Over-dosing is therefore a big risk. Understanding how cannabis is metabolised is therefore important for insurers. The THC (tetrahydrocannabinol – the psychoactive component that produces the feeling of being “high”) can reside in fat cells long after the high has gone and therefore, whilst a person may not be under the influence, they can still test positive.

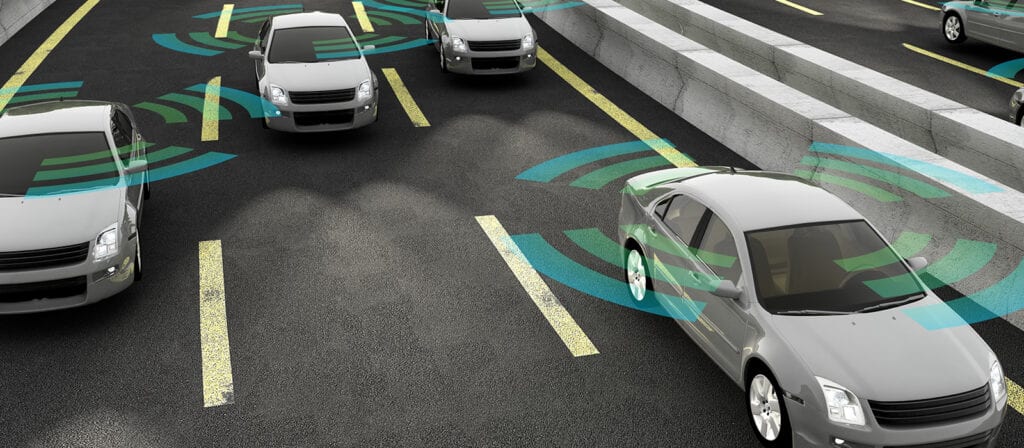

Statistically, there is a 25% increased chance of crashing a vehicle if someone has ingested/smoked cannabis and some studies suggest that the effect is just as dangerous as drinking alcohol. New cannabis users are often also new drivers, which is a concern. A typical Driving Under the Influence (DUI) charge has an arbitrary ‘positive’ number when testing. But for cannabis users, breathalyser results are not accurate, saliva tests are better, but are difficult for police officers to carry out. Enforcement officers have trialled a 12-step drug recognition assessment for identifying those users who are over the limit.

It is important that packaging does not appeal to under 18-year olds and that there is widespread education about the effects which various forms of cannabis might have. Packaging requirements must avoid the risk of a person mistakenly ingesting cannabis and consumers need careful assistance, with clear dosage guidelines, in order to manage this risk from a liability perspective.

Any insurer considering diversifying into this market should look at the new and existing data to understand this new risk. A conservative approach might start with specialising in just one aspect of the risk, ensuring that it reflects the insurer’s risk appetite. It would also be prudent to ensure this product line sits comfortably with the attitude of your existing and potential customers.