In the last few decades, technological changes occurred at a fast rate and will continue to move even faster. We have seen the advent of personal computers, the internet, mobile and smart phones, the explosion of data, and now the connected world. Connected cars and homes are already becoming commonplace, while connected healthcare is being developed rapidly.

Big data will completely change the way we understand risk. When risk management can be carried out in real time, insurers can feel more comfortable about taking risk, so the explosion of data creates massive opportunity, if we can think about risk in a different way. Furthermore, younger generations only know a data-driven world so their expectations will be for immediate, tailored services.

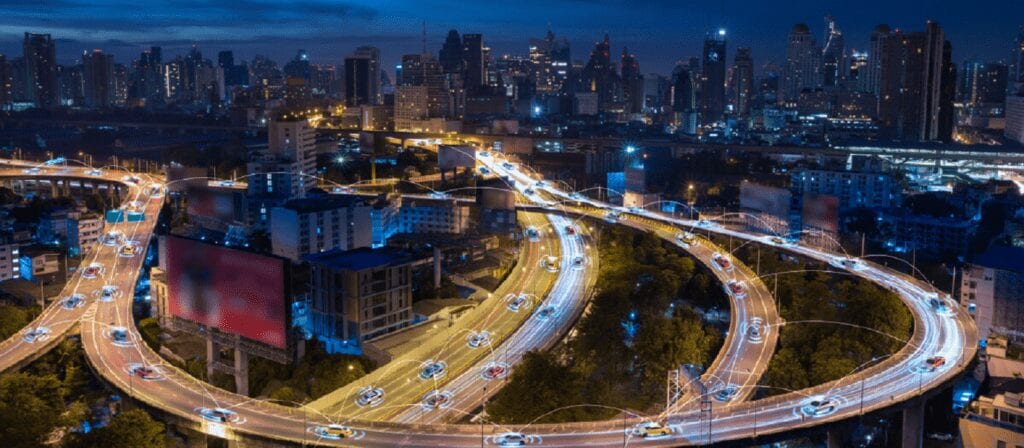

Insure The Box specialises in telematics which is the first type of the application of the internet of things (IoT). Their telematic boxes contain an accelerometer, a GPS receiver and firmware that controls how the data is used. They are used particularly for the younger driver market, but can also be used for safety, vehicle maintenance, and so on.

Data privacy and security need to be managed, and customer information and communication requires considerable investment. Telematics can be used to give immediate information to the customer; to incentivise better driving behaviours; to reward good behaviours with lower premiums; to reduce fraud; to allow for a more tailored relationship with customers; to have proactive control over the claims management process in the case of an accident; and to save lives. The next step could be based on real-time feedback, for example, sending live warnings to drivers who are speeding and, should they ignore the warning, for the vehicle to be taken over remotely and put into automated driving mode.

Current data sources will be replaced by new data sources; cars will have different autonomous driver features (mostly depending on price barriers), and it is already possible to issue software updates that adapt a car’s functionality cheaply, immediately and remotely.

While the cost of repairs will increase due to the cost of more sensors, the accident risk will fall, and over time, the price of motor insurance will fall dramatically. Brockman believes it will take 15 to 20 years before self-driving cars are commonplace. In the meantime, disputes will arise regarding liability for accidents; insurers need to understand the technology. This represents a big opportunity for the (re)insurance market.

Existing infrastructure (buildings, streets, etc) will make it impossible for all personal transportation to be comprised of self-driving cars. With advances in battery power, hovers could become very popular. It may take 30 years, but the pace of technological change means it could be even sooner.