It seems like there is no part of our lives that COVID-19 hasn't touched. From our work lives to our households and our most casual interactions, most people have adapted to our new way of life. Arguably though, the biggest impact has been on our places of work where the coronavirus pandemic has accelerated the digital transformation – and exposed weaknesses in insurers' ability to respond to changing customer needs in an increasingly online world. Tactical distribution solutions are a good start but to compete with BigTech's leading customer experience and rivalling add-on services, traditional insurers must embrace a multi-channel approach in the creation of their digital customer journey.

COVID-19 catalysing digital adoption

Lockdowns pulled people from offices across the world. Retail stores and hospitality venues shuttered almost overnight. Now, as we start looking to the future and wonder how we get back to the office safely, people are questioning whether our understanding of 'the office' is outdated as we navigate a technological revolution.

The impact on businesses, however, goes beyond merely where the staff might be located. Coronavirus has accelerated the gradual pre-pandemic digital transformation and created new business models and distribution networks that will change the way we do business.

Many consumers have adapted their digital behaviour due to the pandemic. In the US, for example, 58% of consumers indicated that they are spending more of their money online, 27% subscribed to at least one new digital streaming service, and 42% purchased more through mobile devices (D. Armano, 2020).

Engagement opportunities for insurers

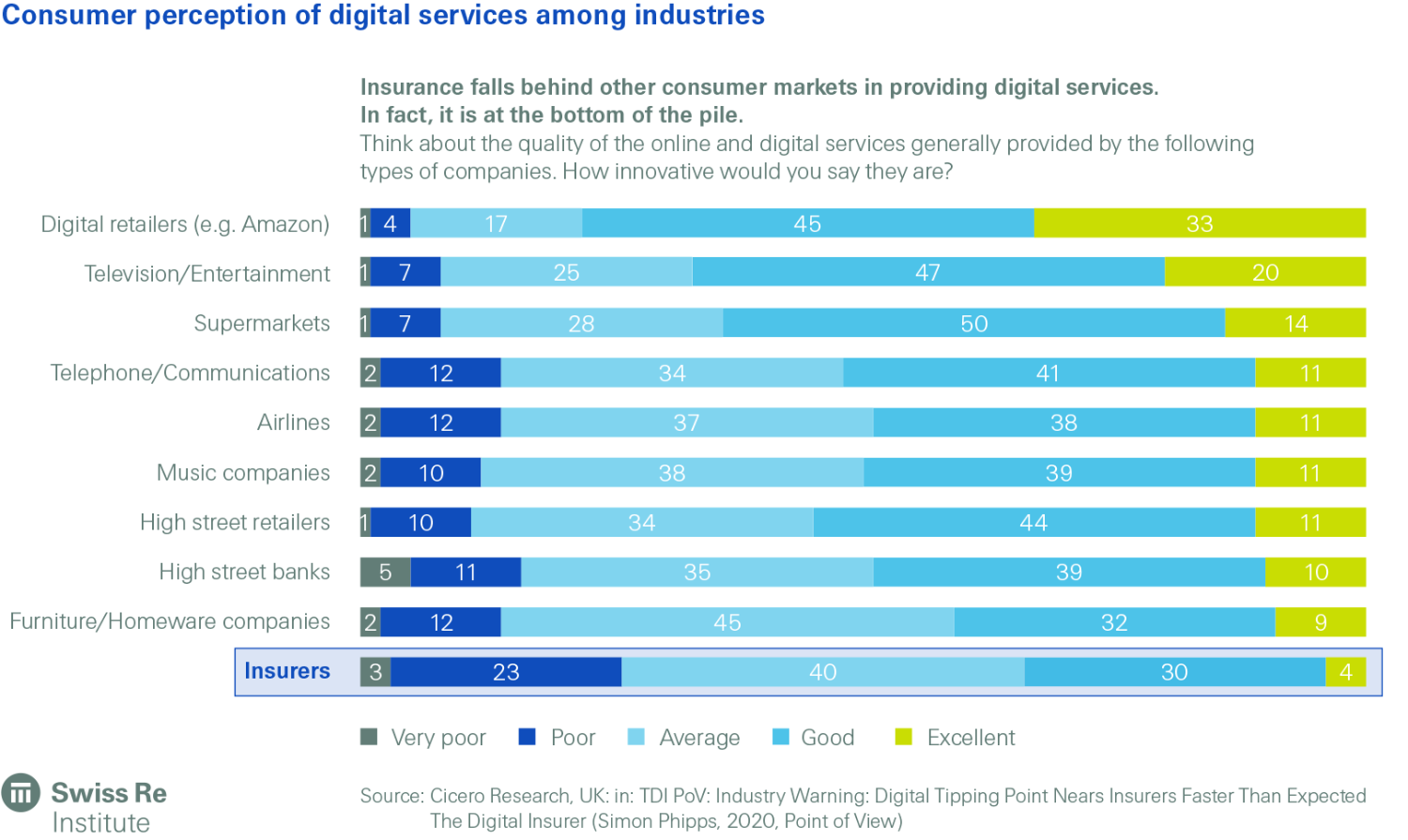

For insurers, the pandemic has exposed one of their greatest weaknesses: their digital capabilities. The below graph shows that in the UK, consumers rate insurers and their digital offerings at the bottom of the pile. Insurance is still an industry with many forms to fill in and information that is shared by hand. It has also resisted implementing digital technologies unlike other industries. As we see digital adoption ramp up, insurers not only risk being left behind but could become obsolete with other companies offering insurance as an add-on service.

COVID-19 has generated growth opportunities and opportunities for better customer service. For example, the pandemic changed motor insurance requirements because of altered mobility needs. Several insurers now offer refunds based on reduced motor vehicle use. With our more digital way of working, cyber crime is increasing, which could be an agile business opportunity. Insurers need to understand how people's exposures change to tailor and personalise the products that they truly need.

In insurance, the sudden loss of face-to-face touchpoints in many markets resulted in overloaded call centres. Possibly one of the industries with the most consumers asking questions as the pandemic progressed – across health, business interruption, payment protection, and travel verticals – many insurers were unable to satisfy their customers' needs.

Only 40% of insurers have a digital strategy, although most claim a set of best practices (Insurer Digital Strategies, 2020), yet two thirds of insurance executives believe digital adoption will be a trend even after the pandemic (Sapiens, 2020).

Changing customer expectations

BigTech companies are leaders in personalised, tailored services. They have the information and the agile business models that allow them to continuously adapt, pivot and respond. From Amazon's suggested bundles and recommended products, and Google's ranked search results and optimised searches to social media's ability to advertise things you may only have spoken about, people are now familiar with the convenience that comes from personalisation. They make a willing trade, surrendering their data privacy based on individual preference in return for customised services.

Insurers have failed to meet this rise in expectations. Even simple insurance purchases require long questionnaires, lengthy assessments and channel-shifting, making it easier for BigTech interlopers. Tesla, for example, armed with real-time customer and vehicle information, started offering car insurance in specific cases in limited geographies in the US in 2019, and the company is reportedly expanding into China (Yang, 2020).

In some instances, Tesla was able to offer prices 20-30% cheaper because of the data it had access to on both customer (driving) behaviour and the vehicles. Data-driven business models use data insights not just for efficiency reasons, but also for better customer experiences. Although many typical insurance companies cannot match the level of knowledge Tesla has on its vehicles and drivers, the expectation that they should be able to do so is there.

In some countries, insurers have offered refunds to customers with reduced driving rates and even responded to public sentiment with discounts or enhanced covers to NHS workers. While these solutions are good responses, they are not really integrated digital solutions. They may factor in customer experience and raise approval or trust ratings, but they don't make insurers agile, responsive digital providers.

Why the customer experience is even more important

BigTech companies offer seamless customer journeys with little channel hopping, immediate purchase options – like one-click ordering – and a host of other services or products that a customer might like based on previous touchpoints or interactions with partners. Customers spend between 15-20 seconds on a website before they decide whether to stay or leave (NNGroup, 2020). This is worrying for insurance companies that need to ask for a wealth of personal information before giving the customer a mere quote.

There is a proven correlation between a better user experience and higher loyalty rates, which in turn translates into how likely a consumer is to purchase more, forgive bad experiences or recommend the company. Given that recommendations from friends and family are key to how people make decisions about their financial services providers (World Insurance Report, 2020), insurers must not just keep consumers satisfied, but keep them happy.

Why data- and tech-driven convenience almost always wins

Consumer experience is evolving as people become more familiar with online services. Although digital offerings vary from insurer to insurer, in the early stages of the pandemic, companies either upgraded their digital functionality or built it. Insurers responded with very basic, almost firefighting, capabilities to emerging needs: online-first loss notification as a response to overloaded call centres or a payment gateway for online renewals. Although these rather tactical solutions are admirable steps in embracing the shift to a digital world, they are, at best, an emergency stop gap and a small piece of what should be a larger infrastructure shift.

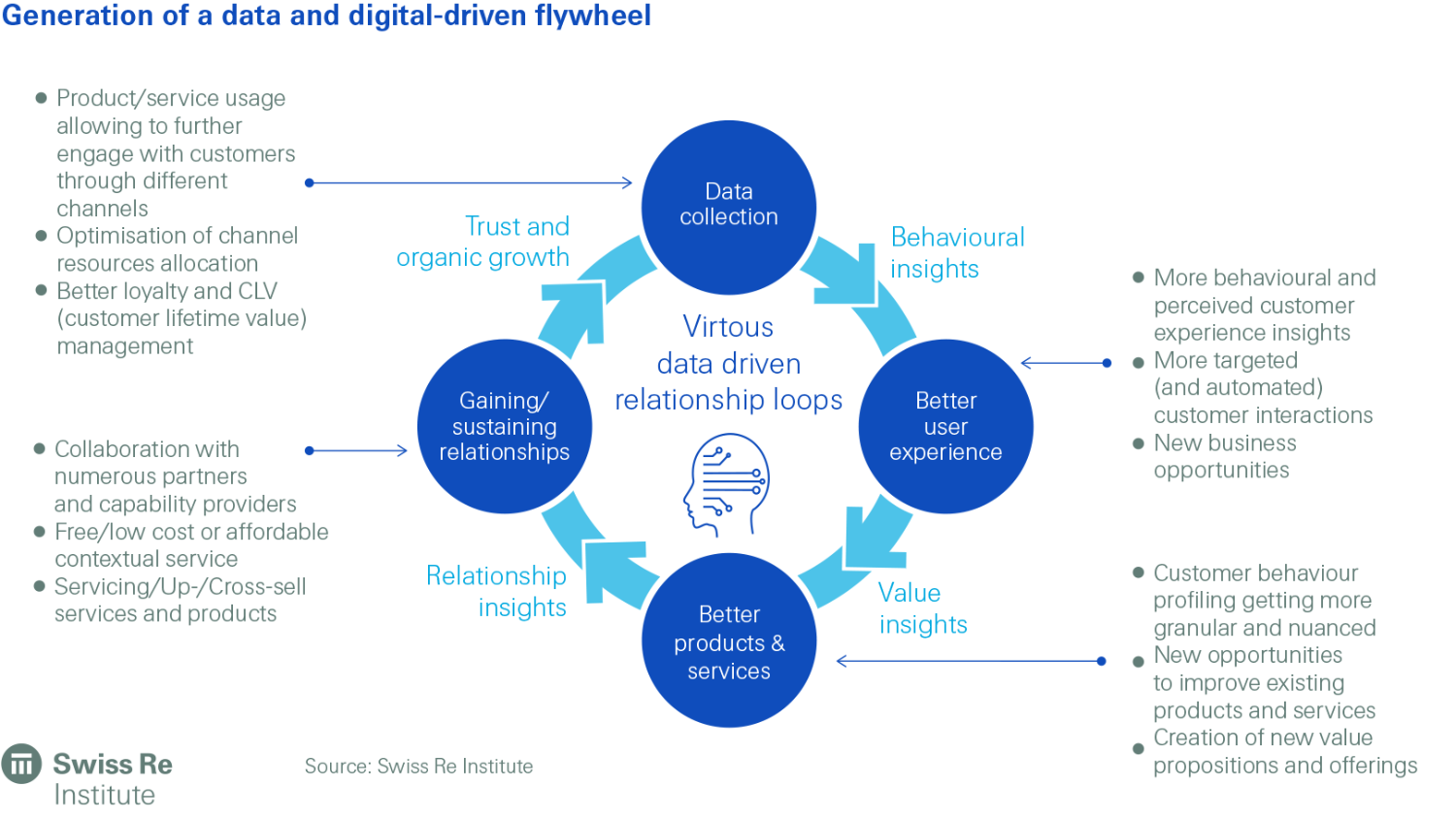

Consumers who use online platforms need a continuous user experience. The current basic level of expectation is an integrated, seamless customer journey. This offers the possibility of continued contextual interactions, which result in better data insights on consumer behaviour. With these insights, companies can create and improve their current products and offer timely value-added and tailored services.

This virtuous data-driven relationship loop – a flywheel – is the foundation of the BigTech companies' success (see image below). It enables them to respond agilely to new insights and continually improve their products and services, which generates more consumer trust and higher organic growth (Avramakis, 2020). Insurers have not yet built the digital infrastructure necessary for this type of business model.

Insurers should feel threatened. In 2016, 17% of respondents of the World Insurance survey they would consider purchasing insurance from BigTech. In 2020 that number more than doubled to 36%.

How are distribution channels impacted?

A move to more online services doesn't erase brokers from the insurance business model. COVID-19 may have halted face-to-face meetings, but virtual conferencing solutions such as MS Teams and Zoom can keep people connected. Many physical interactions, such as personal styling appointments, work meetings, even virtual dating, are successfully moving into the online sphere.

Brokers, impartial advisors with detailed knowledge of insurance products, remain a vital component of the value chain. According to an Ernst & Young survey in Australia, 60% of insurers believe that brokers are still effective sales drivers. They offer a personal, customer-centric touch that insurance services generally lack.

Complex insurance products – like health and life insurance – still have relatively low online purchase rates in many markets (see Data-driven insurance: ready for the next frontier). Insurers need to consider why consumers are attached to traditional approaches and how best to address their concerns. When consumers are faced with complex decisions, they seek sensitive, personalised and relevant answers to their questions.

Currently, many insurers don't have the capabilities to offer this type of customer experience online. To get answers, consumers will channel shift and call, turn to a live chat function, or approach a call agent or broker. If they are still unable to find relevant, personal information, then they are likely to switch providers (Roos et al. 2004). This might change over time as bots become more naturally integrated, although they have a long way to go in their capability to act appropriately in complex interactions.

A Net Promoter Score (NPS) is a tool to assess the loyalty of a firm's customer relationships. The NPS scores of life insurers show that there is room to shift satisfaction rates (with over 50 generally considered to be a great score), and that multi-channel options for engagement have higher success rates.

The following two scenarios outline the difference between a call centre and a multi-channel approach:

In the first scenario, a consumer calls his or her insurer and gets an automated message directing the consumer to its online chat. The consumer acts as directed and spends five minutes describing his or her request online before the chat agent says they're sorry, they don't know the answer and tells the consumer to call and wait in the telephone queue to speak to a live agent.

In scenario two, the consumer hits the "contact us" tab on an insurer's website and gets invited to a live chat. But the live agent is unable to assist after learning of the enquiry and offers a call-back service within the hour from an agent who will have all the information the consumer just provided.

The multi-channel approach uses different layers to efficiently meet individual customer needs, and gives the impression that the company cares about its customers as individuals.

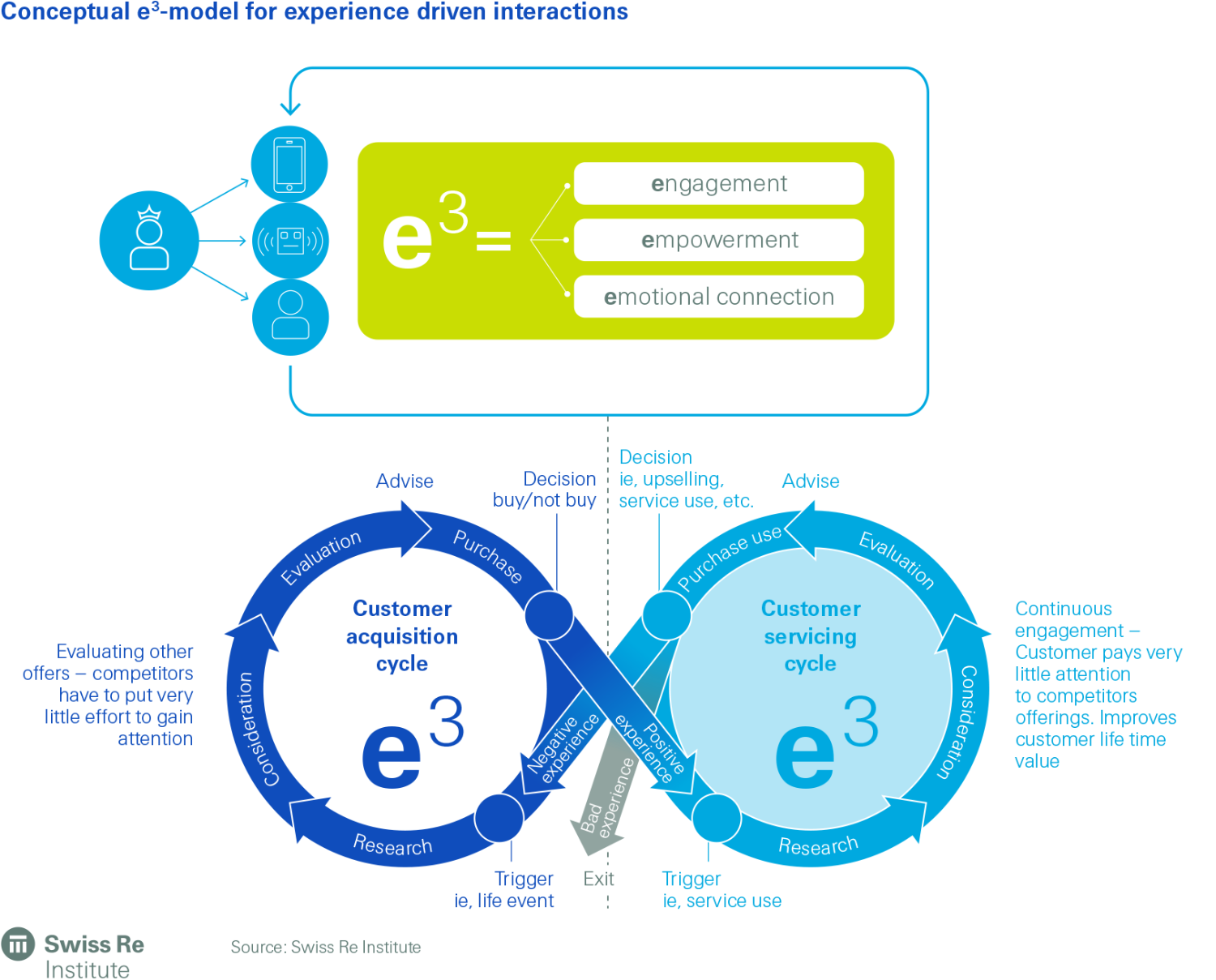

e3 - Changing the nature of the customer experience

Insurers should integrate three vital layers when building new products, services and touchpoints.

- Empowerment: Insurers need to empower their customers by enabling them to access relevant information to make informed decisions. This way insurers can establish a relationship based on trust.

- Engagement: We discussed the role of the broker and consumer preference for channels, but engagement goes beyond just the platforms and channels insurers choose. Better insights into customers’ interests and experiences – with their permission – help companies to design and offer solutions that will be more appreciated and valued. Providing time-relevant offerings on channels people are most likely to frequent is the best way to drive engagement and improve customer opinion.

- Emotional connection: Emotional connection results from a combination of companies' ethics and social responsibility, the way they treat their employees, the causes they champion, and their relationship building experience. Showing genuine and authentic care for both employees and consumers increases the emotional connection.

To rival key tech players, insurers must engage with consumers in ways they respond to, empower consumers with relevant, up-to-date information, and show they care about their customers and society. In the rush to digitise and adopt new technologies, insurers also need to embrace their ability to personalise their customer service.

This article was written by Corinne Fitzgerald, Researcher, Swiss Re Institute & Aakash Kiran Raverkar, Research Analyst, Swiss Re Institute, and Evangelos Avramakis, Head Digital Ecosystems R&D, Swiss Re Institute, and reproduced with the kind permission of ICMIF Supporting Member Swiss Re.

The full article can be accessed via this Swiss Re Institute webpage.

Published February 2021